Clavister Holding AB

Cybersecurity for mission critical applications made in Europe. Profiting from heightened defense & cybersecurity spending in Europe.

As always,

I am very grateful for any feedback.

Do your own due diligence. Fact-check anything I say. It’s always possible that I made minor or major mistakes, even though I rigorously try to avoid them.

Clavister is an illiquid stock, so there is the possibility for major volatility and other liquidity related issues.

If you have any questions, feel free to reach out!

Disclaimer

This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your research & speak to a financial professional before making investment decisions. Stock prices and market value have changed since the time of writing. This is NOT a buy or sell recommendation.

The valuation & forecasted IRR figures are based on a stock price of 3.9 SEK.

Although Clavister doesn't fall into the category of exceptionally cheap opportunities I typically focus on, I decided to complete and share this report regardless, as I had already done most of the work during a collaboration with a Scandinavia & DACH focused public equity fund.

At the current price, I view Clavister as slightly undervalued, with a significant portion of the optionality already priced in. Based on today's valuation, I believe the range of potential IRRs is very wide, roughly between 10% and 40%, depending heavily on the multiples in a few years.

If the stock were to fall to roughly 2.5 SEK, I believe the case would become highly compelling, offering a potential +20% IRR with relatively high security and capturing a large part of the optionality essentially for free.

Introduction

Clavister is a Swedish cybersecurity company specialising in Identity and Access Management (IAM) and Next-Generation Firewalls (NGFW). It offers and continuously develops proprietary solutions for critical infrastructure sectors such as 5G telecommunications and energy, as well as public institutions. Additionally, the company has a strong niche in defense related cybersecurity, particularly with its CyberArmour product, aimed at military platforms (vehicles, naval vessels…). Clavister primarily operates in the Nordics (40% of 2023 revenues) and Europe (30% of 2023 revenues), with ongoing expansion efforts in Germany, France, Benelux, and the defense sector across NATO countries. Its offerings are mainly software-based, complemented by hardware, consulting, and support services.

Growth in their non-defense related business (AIM and NGFW), which accounts for approximately 80% of revenues, is driven by increasing cybersecurity threats and regulatory tailwinds. Furthermore, the successful completion of a transition to a recurring revenue model in 2022 has significantly reduced the business volatility that previously characterised its operations. I expect this part of the business to grow with 10-15% p.a., in the coming years.

The defense segment, which accounts for approximately 20% of revenues, holds significant optionality and serves as the primary driver of the company's growth narrative. Growth is primarily driven by the increasing integration of CyberArmour into a growing number of defense platforms, generating revenue with each new sale or upgrade of an existing system. This expansion is supported by substantial increases in defense budgets and the rising demand for European-made cybersecurity solutions. Their strategic partnerships with BAE Systems and General Dynamics, along with their inclusion in the NATO catalog, underscore the strength and credibility of their defense offering. This segment does not contribute to annual recurring revenue (ARR) and is characterized by significant volatility in order intake, as well as multi-year initial contracts followed by very long-term maintenance and support contracts. Contracts typically have a higher proportion of hardware orders, resulting in lower gross margins (GM) compared to the non-defence segment. Nevertheless, it is expected to be the primary growth driver in the coming years and has already played that role in FY24. I expect this part of the business to grow by more than 50% per year in the future. This growth is supported by secured contracts with BAE Systems for the CV90 vehicle worth over 290 MSK since Q4 2023, most of which are expected to convert into revenue over the next five years. Additionally it is supported by strong momentum in order intake from BAE Systems, alongside significant optionality from potential new partnerships and a range of existing collaborations, such as those with General Dynamics and Thales, that have yet to generate orders.

Upside & Risk Summary:

Management aims to achieve positive EBIT for the first time in FY25, driven by revenue growth. I expect operating leverage to continue in a similar fashion in the following years, primarily due to the company’s sales being channeled through partners, as well as a stable amount of spending on R&D/capitalised development costs.

Based on my base case assumptions, the business is trading at an EV/EBIT of 18x or 3,7x EV/Sales for 2027e. With strong continued growth expected, a high degree of recurring revenue in the core business, a large and growing backlog, and significantly higher multiples for peers, the stock appears potentially undervalued, offering a potential IRR of 10–40% over the next three years, depending on valuation multiples (EV/Sales 5-10x in 2027e). The valuation model can be found at the end of this report.

In my view, the primary risk is the potential failure to capitalise on future growth opportunities, both with existing and new partners. This risk is particularly significant given the company's current high EV/Sales multiple of 7.5x, which can only be justified if the company achieves strong growth a goal that management expects to accomplish. Essentially the entire case hinges on Clavister’s ability to secure new, CV90-sized contracts from existing and new partners in the defense segment, as this will be the primary driver of growth and therefore operating leverage.

Clavister has experienced strong overall order intake growth in recent years, boosted by significant defence orders in Q4 2023, Q4 2024 and Q12025, for the BAE Systems CV90 vehicle. This has increased the order book to 350 MSEK in Q12024, equivalent to approximately 1.5 years of revenue. The order book includes c.6-7MSEK in ARR.

The ARR has shown steady growth and currently accounts for roughly 70% of total revenues. However, defence contracts typically do not include an ARR component and tend to have lower gross margins (GMs), which explains the overall decline in GMs. Additionally, as only a small portion of the newly secured orders have been converted into revenue so far, it is reasonable to expect further GM compression going forward.

Regarding OPEX, Clavister began restructuring its cost structure in 2017, transitioning from an R&D-heavy model with small, one-man sales forces scattered globally to a Europe-focused sales force and more ROI centric R&D efforts. The initial restructuring phase lasted until 2020, followed by an additional cost-saving program implemented in 2021 and completed in mid-2024, which significantly reduced Adj. OPEX despite strong revenue growth. Furthermore, a sharper focus on key sectors (public sector, critical infrastructure, and defense) has contributed to a leaner cost structure. The transition to a SaaS/ARR-centric model for the AIM and NGFW business has also been crucial, as the previous license-based sales model required greater emphasis on customer retention and renewals. Since 2023 a clearly observable trend emerged: operating leverage. As adjusted OPEX has grown at a much slower rate than revenues, and is expected to continue doing so in the future.

Quickly touching on financial items, most of them are related to currency exchange effects on debt in euro, accrued interest and other non-cash expenses, decreasing the financial risk. In a later chapter I will more deeply explore the capital structure and touch on debt as well as debt maturity.

The defense and non-defense businesses are very different, as the defense part of the business mostly relies on a handful of partners and huge orders, while the non-defense segments (AIM & NGFW) have opposite characteristics. Therefore I am going to analyse the two separately.

The first three segments are non-defense. I’ve included Mobile Core Security (MCS) under Network Security (aka NGFW), while Tactical Security represents the defense segment.

Non-Defense - 80% rev.

The non-defense part of the business consists of the AIM (Access and Identity Management) and NGFW (Next-Generation Firewalling) segments.

These business segments have consistently achieved low to high teens revenue growth over several years, serving +20,000 customers since its inception. Sales are primarily conducted through a network of +500 partners and resellers, many possessing specialized sector expertise, such as Nokia in the 5G telecom market, with the in-house sales force focused on supporting and expanding this network. In recent years, the distributor structure in core markets has been simplified through the establishment of sole distributors.

Following significant investments in product specialisation and development, which led to a complete revamp of its solutions including new sector-specific offerings and AI-driven cybersecurity innovations, Clavister is now focused on strengthening partner relationships, optimising solution packaging, and investing in its salesforce.

The IAM segment generates next to all of its revenue from the public sector and primarily operates in the Nordics, particularly Sweden, where it holds a strong, market-leading position. Expansion into the DACH region is ongoing through partnerships and resellers. The NGFW segment primarily serves critical infrastructure sectors, including energy utilities and 5G telecom networks, and operates on a global scale, with a particularly strong position in Europe.

Sector Exposure

Clavister's solutions are highly versatile and can be applied across nearly all sectors worldwide. However, management has deliberately chosen to focus on industries where Clavister has a competitive advantage and significant experience, as well as where strong growth is expected. At present, the company is primarily focusing its growth efforts on the public and energy sectors.

Public Sector

The majority of Clavister’s non-defense revenues comes from the public sector, ranging from local municipalities to large institutions such as federal police force and defense ministries.

Energy Utilities

Clavister secures Industrial Control Systems and Supervisory Control and Data Acquisition systems, ensuring protection across IT, OT, and IoT. The energy cybersecurity market is among the fastest-growing, expected to grow 18% annually until 2035.

Telecom

In the telecom sector, Clavister primarily operates through its NGFW solution. As more telecom solutions increasingly rely on internet connectivity, the need for robust firewall protection has grown, making cybersecurity a critical component of the industry. Although the telecom segment has struggled over the past few quarters, signs of recovery are emerging. In Q4, Clavister secured two new contracts in Asia and one in North America, reflecting a turnaround in demand.

Others

Clavister’s versatile solutions have also attracted customers outside its core sectors, such as International Workplace Group plc in the UK and other SMEs globally.

Contracts & Products

The NGFW solutions typically consist of both hardware (externally produced by MilDef) and software components. The initial hardware sale carries low margins, whereas the software component offers significantly higher margins and recurring revenues. Therefore, the currently strong growth in NGFW is negatively affecting GMs. In contrast, the AIM segment exclusively sells software, ensuring consistently high margins from the start.

Previously, software was sold through licenses that required periodic renewals, demanding substantial sales effort. Since 2022, Clavister has shifted its focus toward a SaaS model, reducing the workload needed to retain existing customers and allowing the sales team to focus more on acquiring new clients and driving top-line growth.

Additionally, contract lengths have been intentionally shortened to enable regular price increases and eliminate discounting practices, with an expected avg. annual price increases of 5–7% going forward. Driven by the strong position in the NGFW Segment and by relaxation of the competitive environment in Sweden.1

Competition & Competitive advantages

AIM is well-established in the Nordics, with strong partnerships and large clients, while its current expansion efforts are focused on Europe. While NGFW has a strong global presence, with a focus on Europe, in the critical infrastructure space and is growing in line with the very fast growing market.

Competitive Advantages

The key advantage of Clavister is its European base of operation and independence from U.S. regulations, as many American cybersecurity providers are known to have NSA backdoors. This makes Clavister a preferred choice for organizations prioritizing data sovereignty. A 2023 study found that 65% of EU public sector organisations prioritise EU-based cybersecurity solutions, a trend further amplified by recent geopolitical tensions and a deteriorating U.S.-EU relationship. Clavister considers this a, if not the, core unique selling point.

Another advantage is the significantly smaller technical footprint of the solution compared to most competitors who build their software on existing operating systems (OS) like Windows. A technical footprint refers to the complexity, dependencies, and exposure of a system, smaller footprints mean fewer components, reduced attack surfaces, and better security. While using existing OS platforms offers ease of deployment and system change, it also creates security risks: if the OS is compromised, the security software can be breached through a backdoor. Clavister mitigates this risk by developing standalone security solutions that operate independently of any OS, making them significantly harder to hack.

Additionally, its technology is highly efficient, consuming minimal CPU power, unlike many cybersecurity solutions that slow down applications due to their larger technical footprint.

Despite operating in a highly competitive cybersecurity market where pricing plays a major role, Clavister has demonstrated pricing power, by increasing and planning to further increase software prices by 5–7% annually

By concentrating on a select number of key sectors and maintaining a Europe-first strategy, Clavister leverages its strong references and market position to stand out from larger, more generalised competitors.

Given these factors, it becomes evident why Clavister’s solutions are particularly suited for critical infrastructure, public institutions, and defence platforms, where data sovereignty, experience and security are paramount.

Competitors

Clavister’s non-defense segments primarily competes with large U.S.-based cybersecurity providers such as Palo Alto Networks, Fortinet, and Cisco, which dominate the traditional cybersecurity market. In the NGFW market, Stormshield, a French company particularly strong in its home market, is the only relevant European competitor.

Growth Drivers

General

Clavister's base business is expected to grow its revenues with 10–15% per year, as hinted at by the CEO in the Q4 FY24 Call. This aligns with broader market growth projections, as both the IAM and NGFW markets are expected to expand at mid-teens percentages over the coming years, according to Gartner.

This growth is supported by increasing cybersecurity threats, exacerbated by the conflict in Ukraine and further reinforced by NIS2, the European Union’s updated cybersecurity directive. NIS2, set to be implemented in FY25, expands cybersecurity requirements to more sectors and entities, enforces stricter incident reporting, and introduces higher penalties. The directive is expected to significantly boost cybersecurity spending across European businesses and institutions.

The increasing demand for cybersecurity solutions is also reflected in Clavister’s own study, which found that 90% of businesses are upgrading or planning to upgrade their cybersecurity infrastructure. All industries are experiencing a rise in technology adoption and increased internet connectivity, both of which drive the demand for cybersecurity solutions.

Ties to NATO

Clavister has strengthened its position in defense-related cybersecurity, which has also positively impacted its non-defense business. This is reflected in a contract win, in Q3 2024, from a NATO member’s defense ministry, which selected Clavister’s IAM solution to secure both civilian and military personnel.

Price Increases

Pricing plays a key role in Clavister’s growth and profitability strategy. It has been implementing aggressive price increases, with the CEO indicating in Q4 FY24 that annual increases of 5–7% are likely to continue going forward.

Churn Rate

Churn has been elevated in the past due to the shift to a Europe-centric focus, partially leading to a decline in international clients. The total impact on ARR and revenue has been negligible, as the overall business grew very strongly. Only the NGFW business was impacted and had a churn rate of 10% in non-EU, which since then has normalised to 3-4%.

New Partners

Clavister is expanding its partner and distributor network to strengthen its footprint, given that sales are primarily conducted through partners and management highlights a very strong pipeline of new additions. This year alone, the company is adding two new distributor partners in major European countries where its current presence remains limited.

AIM - Access and Identity Management - 30% rev.

The AIM business is primarily focused on the public sector in Sweden, and to a smaller extent across other Nordic countries, with a very small presence in mainland Europe. Furthermore, expansion into the Benelux and the German speaking regions is planned through existing and new partners/distributors. To support the expansion they signed a distribution agreement with Däwyler, a large distributor active in over 100 countries. The collaboration initially focuses on Switzerland, with future expansion into other European markets planned. The business is ARR-driven, with very high gross margins (+95%), due to minimal hardware sales.

PhoenixID, acquired in 2016, is responsible for this segment.

Customers

PhoenixID’s highly scalable solution supports organizations of all sizes, from small businesses to large enterprises and government entities. It has established a strong presence in the Nordics, securing over 20 government entities and 180 municipalities in Sweden while also supporting large ministries across Europe. Notable recently added clients include a major European automotive manufacturer using authentication for over 100,000 employees and the defense ministry of a NATO country.

Products

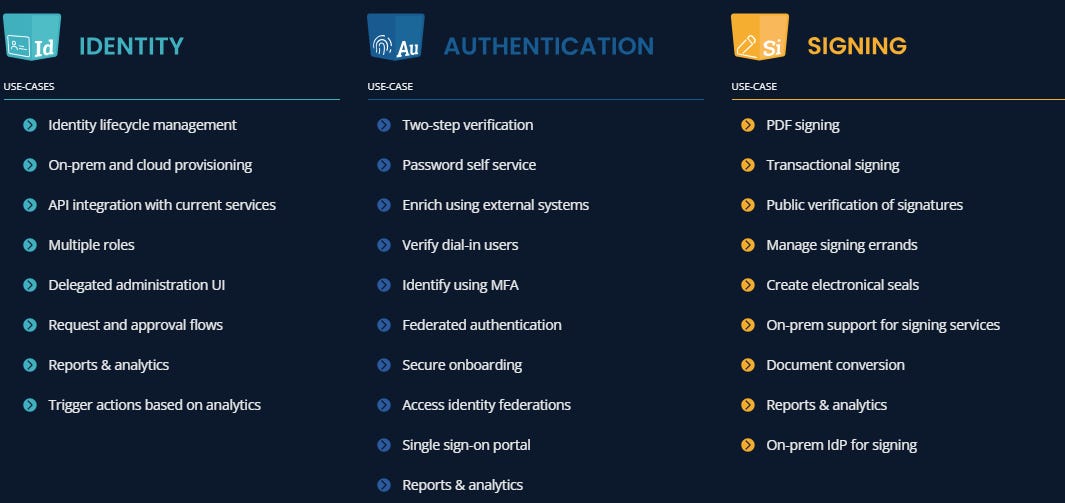

AIM solutions ensure that the right people have the right access to the right resources at the right time by verifying identities, managing permissions, and enforcing security policies. This helps protect sensitive data, streamline user access, and reduce cybersecurity risks.

Next-Generation Firewalling (NGFW) - 50% rev.

The NGFW business relies heavily on hardware shipments, which are essential for expanding ARR since software revenues are directly tied to hardware sales. As a result, initial margins are low, but they improve strongly over time.

Clavister can easily enter new sectors by adapting its core software with minimal hardware modifications. For example, the defense segment’s core solution, CyberArmour, was developed from the core NGFW software with only slight adjustments.

Products & Technologies

A firewall is a security system that controls network traffic, blocking unauthorised access based on predefined rules. A Next-Generation Firewall (NGFW) goes further by not only checking where data comes from but also analysing its contents to detect threats. It enhances security by identifying advanced cyber threats, enforcing safety policies, and improving visibility into network activity. Their offerings are available on-site and virtually for all types and sizes of businesses.

Key Products and Solutions:

NetWall

Firewall solutions designed for all types of networks

The core component of Clavister’s NGFW product line

NetShield

High-performance firewall solution primarily designed for mobile (5G-)networks

Successfully tested in Intel Labs in FY23, demonstrating exceptional performance

PASDA – AI-Powered Monitoring (Launched in FY23)

An AI-driven monitoring solution for the NetWall products

Functions as a standalone solution and can be integrated into third-party cybersecurity and monitoring systems

Customers

Clavister’s NGFW solutions are widely used in critical infrastructure sectors requiring high-security standards. Notable customers include E.ON in the utility sector and one of the Nordic region’s largest law enforcement agencies, which protects over 15,000 users with Clavister’s firewall and VPN clusters. The company also serves a diverse range of SMEs and large corporations, including IWG, as well as smaller municipalities and public institutions. In the telecom sector, Nokia resells Clavister’s technology under its own brand, with major operators like Three UK or NTTBP, Japan’s largest public Wi-Fi provider, deploying firewall solutions by Clavister.

Defense - 20% rev.

The defense business will be the main growth driver and is source of huge optionality in the future. Clavister’s defense segment, saw rapid growth following its 2021 collaboration with BAE Systems. Which led to a 170M SEK contract win in Q4 2023, exceeding total 2023 revenues. As of 15.03.2025, total order intake from BAE Systems stands at 291M SEK, clearly highlighting the growth opportunity.

Contracts & Customers & Sales

Clavister primarily sells its products through an OEM model, integrating its hardware and software solutions into larger defense platforms. The key example of this is its integration into the standard version of the Combat Vehicle 90 (CV90) by BAE Systems, ensuring that Clavister's technology is included in most CV90 sales. However, there have also been cases where customers purchase the software separately from the hardware as a one-off license. Management expects such high margin, deals to become more common, while aiming to transition from perpetual licensing to a SaaS-based model. Nonetheless, the current perpetual model still provides some recurring revenue, as each new vehicle using the software requires its own license.

The revenue model is built on three key streams: (1) hardware sales (very low GM), (2) one-time software licenses (95-100% GM), and (3) recurring support and maintenance fees (75-90% GM2). Hardware accounts for the largest share of both costs and revenues, with BAE contracts carrying approximately 50-60% COGS, compared to 10–30% COGS in Clavister’s non-defense business, in both cases next to all COGS are related to hardware.

While defense contracts typically lack software-related ARR, they provide long-term, high-margin maintenance and support revenues, as military vehicles are expected to stay operational for up to 30 years. Management estimates ongoing maintenance and support revenues at around 0.5–1 MSEK per platform configuration per year. Importantly, this revenue scales with the complexity and number of configurations deployed, not the number of vehicles meaning a single customer with many platform variants (e.g., different CV90 configurations) could potentially generate up to ~10MSEK in ARR. Additionally, the software, and occasionally the hardware, requires updates every few years, resulting in recurring large follow-on orders, albeit smaller than the original contract.

Further defining characteristics of the defense segment are the exceptionally long time it takes to gain new partners, which typically take 5 years from initial discussions to revenue realisation. The process generally follows a structured path: (1) initial dialogue, (2) design win, (3) contract signing, and (4) cash flow generation. Where (1) till (2) typically takes 2-3 years. A design win signifies that a defense platform manufacturer has completed the evaluation of Clavister’s technology and publicly committed to incorporating Clavister’s solutions into its platform, with a high probability of a manufacturer to include Clavister’s solutions in new orders. Due to this very long lead time Clavister is always working on an array of different opportunities at the same time.

Clavister’s primary focus is on securing more platform deals, similar to its partnership with BAE Systems, while selectively exploring projects such as cybersecurity for space or drone applications. Its naturally long customer relationships create medium- to long-term upselling opportunities across defense and adjacent markets. Management is already in talking about potential upselling to other BAE platforms, although this is viewed as a medium-term objective.

A portion of Clavister’s secured platform contracts involves mid-life upgrades (MLU), which tend to offer similar economics to new vehicle sales.

Products

The primary defense solution, CyberArmour, is a firewall-based system derived from the NetWall product, specifically designed and enhanced for defense platforms, consisting of a hardware component (sourced form MilDef) and a Software component based on NetWall. Following the first CV90 contract, in Q4 2021, CyberArmour underwent further development to enhance its defence-grade capabilities.

A new product is in development with a new EU-based hardware vendor, expected to yield higher margins. However, management has not disclosed further details at this stage.

Beyond CyberArmour, Clavister also offers its full range of cybersecurity solutions, including AIM and NGFW products, to the defense sector. These solutions provide comprehensive protection for military networks, ensuring secure communication, data integrity, and threat mitigation across various platforms. Notably, the large order intake related to the CV90s came exclusively from CyberArmour and it is expected that the other solutions will play a small role in the growth of this segment.

Competition and Market dynamics

Market

The war in Ukraine and geopolitical tensions between the U.S. and Europe have driven a surge in European defense spending, increasing demand for modern military platforms. As military systems become more digitized, the need for advanced cybersecurity grows, positioning Clavister to benefit from this shift through its integration into key defense platforms. Notably, the digitalization of battlefield equipment is still in its early stages. BAE Systems was one of the first adopters of highly digitized platforms, but other defense contractors are now following suit. Clavister’s early contract win with BAE is a strong validation of its cybersecurity solutions, reinforcing its position as a key provider of cybersecurity solutions in the evolving defense landscape.

Competitive advantages

Clavister’s standardized, off-the-shelf cybersecurity solution offer speed, reliability, and proven effectiveness, key advantages as the market moves away from time-consuming custom builds. This is further supported by its niche expertise, strong brand, and involvement in large-scale contracts.

As a Europe-native provider, it stands to benefit from the growing demand for EU-sourced defense solutions, a trend driven by the increasing importance of data sovereignty and strategic autonomy. This shift is further reinforced by regulatory and political pressures across the EU, especially as transatlantic relations continue to deteriorate at a rapid pace. For instance, General Dynamics is integrating CyberArmour into some of its platforms for the European market precisely for these reasons (a point I’ll explore in more detail later).

Competition

The closer to the battlefield, the scarcer the competition, as next to no companies specialise in defense cybersecurity. While defense cybersecurity is a major growth area for Clavister, it remains very small compared to the broader civilian enterprise firewall market. Moreover, Clavister’s management emphasizes that its biggest competitors are mainly in-house solutions developed by potential customers rather than large cybersecurity providers, further highlighting the scarcity of third-party and highly specialized competition. Additionally, CyberArmour is the only widely recognised EU-native solution of its kind.

Growth Drivers

General Market Growth

EU defense budgets are seeing a significant rise, largely driven by heightened security concerns following Russia's aggression in Ukraine and a push for greater European strategic autonomy in defense.

Defense Platforms

Clavister’s growth strategy in the defense business is centered around integration of their product into existing defense platforms, ensuring CyberArmour becomes a standard component.

Most important involvements: GDELS & BAE Systems

Naval Platforms

A minor area of expansion is naval defense, where Clavister was approved as a supplier for a large Nordic defense company in Q4 FY24, securing its first naval cybersecurity contract worth 8M SEK. Clavister aims to further expand into naval platforms, leveraging this new reference and knowledge.

NATO product catalogue

Beyond individual contracts, Clavister’s inclusion in NATO’s product catalog in Q4FY24 marks a significant milestone, simplifying procurement for NATO member states. This has already led to new deals, such as a South European customer purchasing CyberArmour while sourcing hardware independently, resulting in a 5M SEK order. The NATO listing enhances Clavister’s visibility, attracting attention from various defense platforms.

Thales

Clavister began collaborating with Thales, one of the world’s leading defense tech firms, in Q3 2024. Though still early, the partnership has already led to CyberArmour’s integration into Thales SOTAS system, a tactical communication network, signalling strong potential for broader adoption across defense and possibly civilian platforms over time.

Adjacent Markets

Expansion into areas like drone and space cybersecurity is part of Clavister's long-term growth strategy, often supported by state-funded R&D. One concrete example is the ongoing project with the Swedish Armed Forces, exploring AI-driven cybersecurity to enhance drone survivability against rising cyber threats.

Price increases

As CyberArmour gains increasing recognition and faces limited competition, Clavister is working to raise prices. Management expects price growth in the defense sector to at least mirror the 5-7% increase seen in its non-defense business.

Pipeline

In late 2024, the management team outlined key future opportunities, with the two largest immediate prospects being BAE Systems and General Dynamics European Land Systems (GDELS). Clavister secured a design win with GDELS in mid-2023, and management believes there is a high probability of orders materialising soon. Additionally, as previously noted, the company is actively pursuing a range of opportunities with other major platform manufacturers, further expanding its potential pipeline.

CV90 (Combat Vehicle 90)

Clavister secured orders in Q4 2023, Q4 2024, and Q1 2025, with a revenue per vehicle of 400.000–450.000 SEK on average.

Concrete Prospects:

Ukraine new orders: Goal of buying up to a 1000 vehicles in the next years

Sweden new orders: 50 vehicles & some for the Ukraine

Denmark new orders: 50 vehicles

Denmark MLU: +50 vehicles

Total potential order intake: 460MSEK (or 60MSEK excluding Ukraine)

Note: Several nations across the EU are ramping up investments in new vehicles, so I wouldn’t be surprised if the number of potential opportunities rises significantly in the coming years.

GDELS

The GDELS deal is tied to NEVA, a software architecture integrating various solutions, with Clavister’s CyberArmour handling cybersecurity. Rather than being limited to a single vehicle, this partnership offers long-term opportunities to benefit from mid-life upgrades (MLUs) and new platform sales across multiple defense platforms.

Concrete prospects:

ASCOD Vehicle MLU: +1.000 vehicles across Europe need upgrades, during which the new NEVA digital architecture will be implemented.

ASCOD Vehicle New Order: The Spanish Army has commissioned +2.000 new vehicles to replace existing ones.

Piranha Vehicle MLU: 11.000 Piranha vehicles worldwide (including in the Nordics) are due for modernization.

Piranha Vehicle New Orders: 350 to 1.000 new vehicles expected.

Context: None of these opportunities are secured yet, but CyberArmour has a high chance of being included. The potential upside is significant, with expected revenue per vehicle in line with previous CV90 contracts (400,000–450,000 SEK) and slightly higher margins than the BAE Systems deal, though exact figures depend heavily on the final order details.

Total potential order intake: +6.000MSEK

BAE Systems - CV90

Won Contracts

CV90 Infantry Fighting Vehicle

The CV90 infantry fighting vehicle, manufactured by BAE Systems, is one of the most widely adopted military platforms in Europe. It is in service with multiple nations, including Sweden, Norway, the Netherlands, and Switzerland, and is highly versatile, capable of integrating various armaments and advanced electronic systems. Among the major defense manufacturers offering infantry vehicles, including BAE Systems, Rheinmetall, and General Dynamics, the CV90 is the currently best-selling platform in Europe, according to Clavister.

Clavister’s CyberArmour is a standard feature of the CV90 platform, since 2023.

History

Clavister’s relationship with BAE Systems began in 2021 with an R&D collaboration, focusing on developing advanced cybersecurity solutions tailored for the CV90 platform. This partnership led to the integration of CyberArmour into the standard CV90, cumulating in multiple contracts and establishing Clavister as the vehicle’s cybersecurity provider. While the current collaboration is focused on the CV90, there is a medium-term possibility of expanding Clavister’s role into other BAE Systems platforms, although this remains a long shot at this stage.

Contracts, Revenues, and Financial Impact

The CV90 contracts primarily include software and hardware deliveries, with some consulting services. CV90-related revenues accounted for 10% of Clavister’s total revenue in Q4 FY24, and major revenue contributions are expected to begin in H2 FY25 as deliveries scale up.

As can be seen in “Won Contracts”, the margins are relatively weak at roughly 40% GM, this is fully driven by the high costs for defense grade hardware from MilDef.

The contract duration is tied to BAE’s vehicle delivery schedule.

Since revenue and costs are recognized upon delivery, the gross margin is expected to remain relatively stable throughout the contract.

Future & Security of the Partnership

Clavister’s long-term involvement with the CV90 program appears secure, as the CEO has stated that as long as Clavister continues to provide high-quality products and strong value, there is no reason why the company should not remain a key supplier for future orders. The CV90 platform is expected to have a 30-year operational lifespan, which presents opportunities for long-term cybersecurity upgrades, maintenance contracts, and new product developments.

General Dynamics European Land Systems (GDELS)

GDELS, one of Europe's largest suppliers of military platforms, partnered with Clavister in late 2023 to enhance cybersecurity for military vehicles. CyberArmour has been integrated into the NEVA vehicle architecture software, which encompasses remote control, communication, and cybersecurity capabilities. The potential is significant, as NEVA is not limited to a single vehicle model, though the initial focus remains on vehicles similar to the CV90.

No contracts have been signed yet, but “we have secured a design win whenever there is a concrete program happening, Clavister has a good likelihood to be included in those defense programs.” - Q3 2024 Investor Call (touching on the GDELS opportunity)

The Gross Margin Issue

Segments sorted by gross margin:

AIM (No hardware)

NGFW: Telecom (some hardware)

NGFW: Civilian Fire Walls (A lot of hardware)

Defense (military firewalls) - (A lot of (expensive) military-grade hardware)

Segments sorted by growth prospects:

Defense: Military Firewalls

NGFW: Civilian Firewalls

AIM

NGFW: Telecom

Clavister's GM is closely tied to the revenue mix between hardware and software, which itself is closely linked to growth.

Historically, the company benefited from high margins due to limited growth, with the NGFW segment, its most important unit, requiring low-margin hardware contracts as a foundation for long-term high GM ARR. While hardware in this segment is essential to building ARR and securing long-term customer relationships, the defense-related hardware sales do not contribute to ARR but come with long-term maintenance and support contracts, and enable the company to better utilise existing resources (OPEX). With both of these segments being the core growth drivers, it becomes clear why one would expect pressure on the GM.

Factors Countering the GM Decline

CyberArmour Software Sales

Growing demand for CyberArmour software sold without hardware, carrying ~95% GM. However, volume remains small relative to large hardware-heavy contracts like CV90. Although momentum is increasing, as can be seen by 3 relatively large orders in the LTM.Alternative Hardware Supplier in Defense & new products

Introduction of a new defense solution with a different hardware supplier could lead to improved GMs.Price Increases

Recently implemented and ongoing price increases contribute to margin stabilisation, across all segments.Maintenance & Support Revenues

Although relatively small compared to total contract size, these recurring revenues help support overall GM.

Nevertheless, these positive factors only partially offset the gross margin differential between defense and other business segments. CyberArmour is still a very new solution, and with limited information available, it remains difficult to forecast margin trends with precision. However, both management and our assumptions suggest a realistic short- to mid-term GM in the range of 70–75%, down from the current 80%. However, given that OPEX is anticipated to grow only marginally, the increase in absolute gross profit will have a significant positive effect on the bottom line

Management

Board of Directors

Andreas Hedskog (since 2023, Chair of the Board & Audit Committee) – 1,755,709 warrants.

Staffan Dahlström (since 2018, Director & Audit Committee Member) – 7,521,584 shares.

Stina Slottsjö (since 2022, Director & Audit Committee Member) – 3,500 shares.

Tobias Öien (since 2024, Director & Audit Committee Member) – 200,000 shares.

Executive Management

John Vestberg (Co-founder, at Clavister since 1997, CTO from 2003 till 2017 and CEO since 2017) – 1,410,200 shares and 4,637,652 warrants.

David Nordström (CFO since 2020) – 237,500 shares and 2,742,500 warrants.

Johan Edlund (COO & CEO of Phenix ID since 2018) – 174,800 shares and 2,732,600 warrants.

Nils Undén (CTO since 2020) – 276,190 shares and 2,757,008 warrants.

Financials

Share Issuance and Warrants

The company’s growth strategy has long relied on equity issuance, leading to a substantial increase in diluted share count. Including the TO8 and TO9 warrants, as well as other warrants, the fully diluted share count has grown from 62 million in Q1 2022 to 326 million in Q4 2024.

However, management has clearly communicated that they do not anticipate further share issuances. That said, if they fail to achieve their targeted positive EBIT this year, it is possible that additional equity issuance will be necessary.

In Q4FY24, the TO8 warrant was issued and fully converted, adding 42,397,764 shares. In April 2025 (Q1FY25), 99% of the 42,397,764 share equivalent warrants were converted, adding another 41,924,473 shares at 1.5 SEK per warrant, resulting in a cash inflow of 63M SEK. All recent share and warrant issuances have been allocated toward debt repayment.

Share count (Following TO9 - Apr.2025):

326M fully diluted shares

309M “normal” shares

17M options & outstanding warrants

Debt

Next to all debt comes from a euro-denominated loan made in 2017 by the European Investment Bank (EIB), with no covenants. With a total debt volume of 19,5MEUR or 229MSEK in Q4 2024, and a variable interest rate of currently roughly 6%. The Management is aiming to be debt free in the mid-term and has been using the TO8 & TO9 cash to pay down part of the loan, reducing the interest and debt load.

Repayment Schedule:

(Pre-repayment via TO8 & TO9)

2024, 2025: 24MSEK

2026, 2027, 2028: 205MSEK

Cash

Cash (Q4 2024): 83MSEK

Total Cash following the TO9: 146MSEK

Deferred Tax Payments

Clavister must repay 76M SEK in deferred VAT from the COVID period, with payments scheduled from early 2024 to late 2026. An estimated 50M SEK remains outstanding (my assumption).

Factoring

Factoring also plays a large role as 90% of total receivables are covered by factoring contracts, with the total amount of receivables still being present on the balance sheet as the risks for bad loans stays with Clavister, therefore acting similarly to a short-term loan. Therefore I assume factoring equal to 90% of receivables (or 58MSEK).

Net Debt

229M EIB Debt

50M tax Debt

83M Cash pre TO9

63M Cash from TO9

58M Factoring

=> 190M NET DEBT

FY25 Interest expenses

Most of the interest paid is to be paid at the end of 2028, currently totalling 12MSEK and expected to grow, leading to high non-cash charges. Generally the financial costs are very volatile as a large part is related to revaluations of the EIB debt following currency fluctuations, which are also non cash charges.

The Management expects a decrease in interest expenses related to EIB of 14MSEK p.a., following the repayment with existing cash. Additionally, the general decline in interest rates should help reduce financial costs, as the EIB loan carries a variable interest rate. I assume that the costs might be as low as 10M cash impacting financial costs for FY25.

Cashflow

D&A & Capex:

99% of CapEx is capitalised development costs

D&A equals CapEx more or less

Both are expected to stay stable at roughly 11MSEK per quarter

Investments are directed toward upgrades and enhancements of existing products, as well as the development of new solutions.

Working Capital:

The negative working capital, is mainly related to deferred revenues & deferred income, stemming from the ARR, which is often paid 12 months in advance.

In the future, inventory may increase due to a shift toward a more hardware-centric business model, but management hasn't touched upon this yet.

I believe the WC level will be roughly stable as a % of revenues.

Operating Expenditures (OPEX)

The company began cost-cutting in Q4 2021 but resumed OPEX investments in 2024, with OPEX only increasing by 5M, despite inflation and huge growth, underlying operating leverage.

Future OPEX:

Going forward, management expects roughly half of gross profit to convert into EBIT, with the other half reinvested into operations. From FY25 onward, I anticipate annual OPEX growth to remain at around 10–15MSEK, potentially increasing if revenue growth accelerates significantly.

The OPEX growth is solely driven by an expansion of the existing sales force, after years of consolidation.

One-Offs in 2024

The one-offs are related to (1) touched upon cost-cutting (2) legal cost (3) sales commissions.

Cost-Cutting

Main driver of non-recurring expenses in FY23.

Cost cutting was primarily achieved through workforce reductions, which resulted in one-time expenses related to severance pay.

Legal Costs

Main driver of non-recurring expenses in FY24.

Due to a single IP infringement cases, which led to +3MSEK in legal fees in FY24.

Lawsuit Costs: Expected to be lower in FY25, estimated at 1–2M SEK.

Ongoing Dispute: Legal proceedings are ongoing against Fortified ID AB, founded by former PhenixID AB employees, for suspected infringement of intellectual property rights owned by PhenixID AB.3

Sales Commissions

Order intake directly impacts sales commission payouts.

Q4 FY24 saw a 70% YoY increase in non-defense order intake, leading to unusually high commission expenses.

One-off commission costs (~SEK 3.5M) are not included in Clavister’s official non-recurring expense line, but should be viewed as a one-off, since targets are adjusted upwards based on prior intake, therefore the salesforce would have to at least hit a level of 80MSEK order-intake from non-platform deals to get anywhere near the 3,5MSEK in commissions.

Q4 FY24 was driven by non-defense orders, unlike Q4 FY23, which was dominated by defense contracts that likely incur minimal commission costs.

Despite a YoY decline in total order intake, the shift toward non-defense orders explains the spike in commission expenses.

Order Book & Order to Revenue conversion

AIM: Direct payment required upon starting to use the service

NGFW: 1 month from order to revenue

Defense: 80% of order book, and mainly related to CV90 orders, with deliveries planned from 2025-2029

Mobile Core Security / TelCo: all ARR, but similar to NGFW large contracts and 1-2 months from order to revenue

Underlying Growth: Even excluding large defense deals, order intake has grown significantly

ARR is only a tiny fracture of the order book (6-7MSEK as of Q4FY24)

Annual Recurring Revenue (ARR)

Scope: ARR solely includes recurring software license sales.

Segment: As previously noted, all the ARR is attributable to the AIM and NGFW segments. I estimate that NGFW and TelCo together account for roughly 50% of ARR, with AIM contributing the remaining 50%.

This is the highest GM revenue and leads to a very high degree of predictability, with churn levels being very low. (I would estimate them to be 2-3% p.a.)

Risks

Interest Rates and Financial Risks

If Clavister fails to grow revenues as planned, which I deem to be unlikely, they will face liquidity issues and likely further shareholder dilution will follow. Additionally, since most of their EIB debt carries a variable rate, a sharp rise in interest rates would be detrimental. The debt is also euro-denominated, while Clavister reports in SEK, making a significant SEK devaluation a material risk. However, with 40% of FY23 revenues in Euros and most the costs (70%) in SEK, this risk is partially offset.

Starkly decreasing gross Margins

Since the defense segment operates with significantly lower margins, potentially around 40-60% GM, there is a considerable risk of a sharp overall margin decline. This could delay the effects of operating leverage, postponing both profitability and, later, the potential for highly positive EBIT, needed to justify current multiples.

Customer Dependence

Clavister’s revenue relies on a few large and mid-sized distributors, for example Nokia or BAE Systems. Currently, 5% of revenues come from CV90 vehicle sales, a share expected to grow significantly in FY25, increasing dependence on BAE Systems and its customers, a similar dependence can be expected from GDELS and other partners when first contracts get signed. However, no single end-customer currently contributes more than 8 MSEK in revenues.

Intellectual Property (IP) Risks

As the business relies partially on IP to maintain its competitive edge, infringement poses a serious risk.

In 2023, former PhoenixID employees allegedly copied parts of the solution, infringing on Clavister’s IP, according to the company. Clavister lost the initial lawsuit in 2024 but has appealed, with the CEO expressing strong confidence in winning. The appeal has now been granted, meaning the case will be reviewed and reassessed by the courts.

The worst-case scenario: A competitor launching a highly similar AIM solution, eroding part of Clavister’s competitive advantage in that area. However, since a significant part of AIM’s strength comes from testimonials by large & prominent customers and accumulated experience this would not completely eliminate its competitive edge.

Latest update 14.03.2025: https://www.clavister.com/company/investor-relations/investor-news/view/?slug=patent-och-marknadsoverdomstolen-beviljar-provningstillstand-i-mal-mellan-phenixid-och-fortifiedid

Software Development Risks

As with all cybersecurity software, there is a significant risk of bugs or hacks. However, strong testimonials, references, and reputable partners suggest high product quality, making this risk less probable in Clavister’s case.

Key Personnel Dependency

As is typical for microcaps, especially those with R&D-intensive business models, the company depends on a few key individuals. This includes executives like the CEO and co-founder, who played a crucial role in shaping and restructuring the business, as well as key figures in the R&D and sales teams.

Valuation

Company Outlook 2025 and beyond

“For 2025, we intend to make selected sales and marketing investments to continue accelerating our sales growth. Our ambition for the full year 2025 is to, despite these investments, achieve an EBITDA margin of at least 20%, a positive operating profit (EBIT) and a positive operational cash flow.” - Q4 2024

Between 2023 and 2025, Clavister has targeted revenue CAGR of +20%, a goal management has suggested could be sustained in the years ahead. However, given the significant potential in the defense segment and the strong momentum in new orders, I believe this target may be too conservative.

Assumptions

Disclaimer:

The assumptions used in this valuation model are based on publicly available information, management commentary, and my own estimates. They are subject to change and may not reflect actual future performance. This model is for informational purposes only and should not be relied upon as investment advice.

Revenues:

Order Backlog: As of April 26, 2025, the order backlog is approximately 350M SEK, with 280M SEK attributed to the defense segment. Revenue from this backlog is expected to be recognised by 2030, providing five years of revenue visibility.

ARR: ARR (140MSEK in Q4FY24) is not included in the order backlog, further enhancing revenue predictability.

Revenue Visibility: Combining the order book (60-70M SEK annually) with Q4 2024 ARR (140M SEK) establishes a 200–210M SEK revenue base.

Revenue Growth:

AIM & NGFW: I deem it probable that the non-defense portion of the business, will grow at least 10-15% p.a., driven by strong market trends, ongoing expansion in AIM and a strong competitive position for NGFW.

Defense: I believe the defense segment has the potential to grow at a rate of 50-75% annually, driven by a strong order backlog, a low revenue base, and multiple growth opportunities, including new large platform contracts, strategic partnerships, standalone software sales, and upcoming product launches. Furthermore, management stated that a 25-30% of total revenues attributed to defense in FY25 is “not unrealistic”, which aligns closely with my model.

Gross Margins

The Management said the following on GMs:

NGFW: 70-75%, due to hardware needed for new contracts

AIM: 95-100%, due to no hardware sales

Defense: No management commentary, I assume a 55% gross margin going forward, based on:

Platform Deals: 40–50% GM.

Other Revenue Streams: Significantly higher margins anticipated from software, support & maintenance, and other touched upon sources

TelCo: 80-85%, but I included it into the NGFW segment, as it is relatively small.

OPEX and D&A

D&A: Stable at 44MSEK p.a. following management assumptions (equal to CapEx)

OPEX growth: 40% of abs. gross profit growth for FY25, followed by 12,5MSEK growth p.a. in FY26 & FY27.

Valuation Model

Notes:

Inputs are highlighted in blue.

Notes on FY23 & FY24 Segment Revenue & Gross Margin, can be found in the Footnote 3.4 All FY23 & FY24 figures are likely only directionally correct and should therefore be interpreted with caution.

I deem a 5-10x EV/S multiple to be fair5, leading to a potential CAGR of 10-40%.

Comps

Clavister shares more similarities with the first two companies in terms of its business model, but aligns more closely with the last three when considering sector and growth drivers. As a result, an EV/Sales multiple in the range of 5–10x seems reasonable. However, it’s important to note that these comparable are between 100 and 1,000 times larger than Clavister.

Closing thoughts

The company offers significant optionality within its defense segment and operates two additional very stable and growing segments. However, given the relatively rich valuation and the fact that future explosive growth is heavily dependent on securing new defense contracts, I do not currently own the stock (ownership can change at any point in time). As I have difficulty precisely estimating the probabilities surrounding the size and certainty of these contracts, despite being confident that many will be secured. In my base case I would require an IRR of over 20%, based on an EV/Sales multiple of 5, to justify taking a position (equating to approximately 2.5 SEK per share).

In addition to the uncertainties not taking a positions is also closely tied to my IRR hurdle of 30%, as I believe that with a base case IRR of 20% based on a relatively low multiple achieving this should be feasible.

Notes

Once a defense contract is secured, such as with BAE Systems, countries cannot easily backtrack, as doing so would severely damage their reputation on the global stage.

Other Revenues/Income

Roughly 2-5% of revenues, primarily consists of R&D grants, focused on AI/ML and defense projects.

Swedish competition previously tried to gain market share through lower prices but recently abandoned this strategy after it failed.

Assumption by me, based on management comments.

See AR23 and https://www.clavister.com/company/investor-relations/investor-news/view/?slug=patent-och-marknadsoverdomstolen-beviljar-provningstillstand-i-mal-mellan-phenixid-och-fortifiedid for further informations

Segment Revenue FY23 & FY24: I had to piece together the segment revenue & GM figures, as the company does not directly provide detailed data. Based on my research and some statements from management, I have assumed that the growth in revenues in the AIM and NGFW segments aligns with past ARR growth. According to management, defense revenue accounted for 10% of total revenue in FY23 and is expected to represent 20% in FY24. The AIM revenue for FY23 is based on private company filings. The gross profit attribution is based on calculations and some of managements statements. All figures are likely only directionally correct and should therefore be interpreted with caution.

As EV/EBIT doesn’t fully capture the apparent operating leverage, I decided to use a EV/S despite not doing so typically.