Medically Facilitated Value Creation

An opportunity hidden in plain sight, turning top-tier hospitals into hard cash and buybacks, one surgical incision at a time.

As always,

I am very grateful for any feedback.

Do your own due diligence. Fact-check anything I say. It’s always possible that I made minor or major mistakes, even though I rigorously try to avoid them.

This is an illiquid stock, so there is the possibility for major volatility and other liquidity related issues.

If you have any questions, feel free to reach out!

Disclaimer:

This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your research & speak to a financial professional before making investment decisions. Stock prices and market value have changed since the time of writing. This is NOT a buy or sell recommendation.

Key Figures of interest

Share Price: USD $10 ($14CAD)

Shares Outstanding (diluted): 19.301 million

Market Capitalization: $191 million

Net Debt: -$23M (with ~38M Cash & 15M debt attributable to MFC)

Name (Ticker): Medical Facilities Corporation (DR.TO)

All figures in USD

Multiples:

Normalized FCF: ~$23M

MC/FCF: ~8x

FCF Yield: ~12%

Summary

Business: Medical Facilities Corporation (MFC) owns majority stakes in three U.S. specialty surgical hospitals focused on high-value orthopedic and neurosurgical procedures. These are localized, market-leading assets with resilient demand and a strong payor mix.

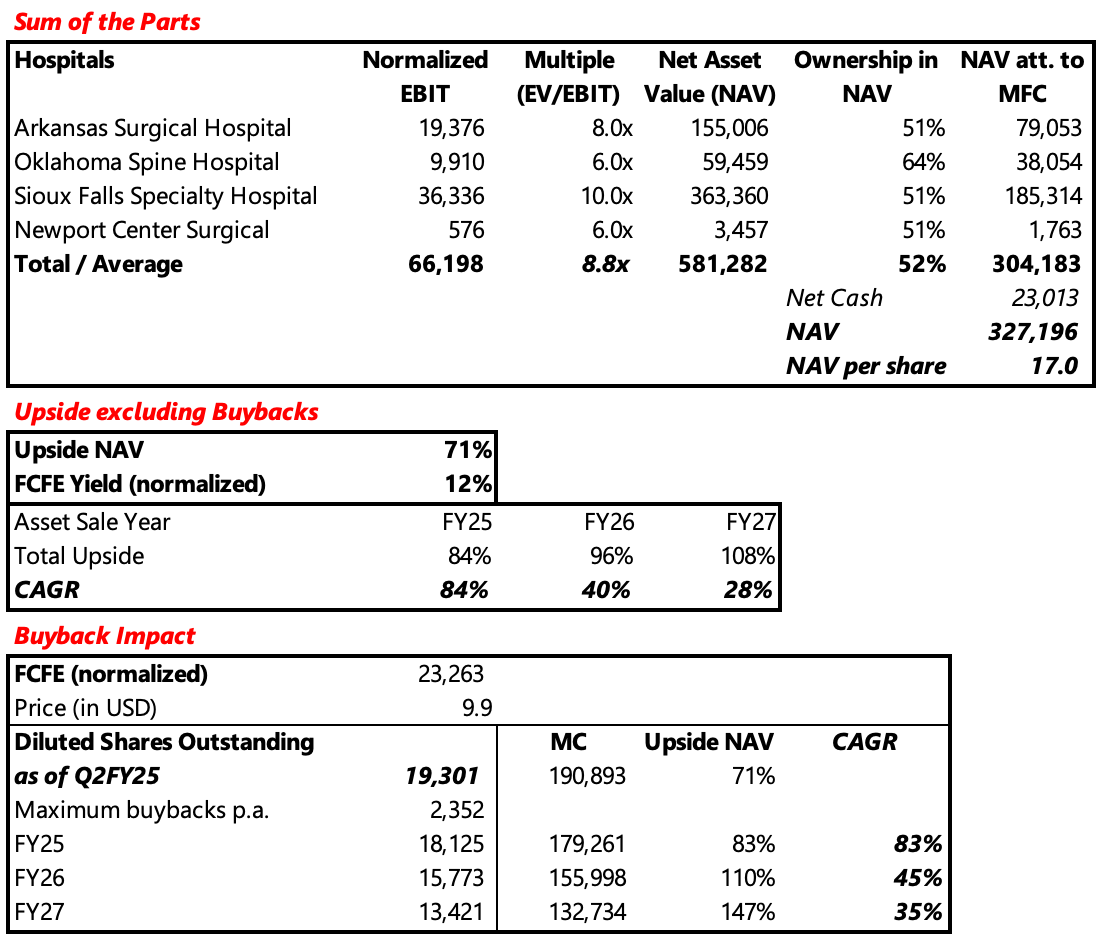

Upside - (1) Strategic Realization: The most likely scenario is a full sale of the hospitals followed by share buybacks or dividends, unlocking NAV value of roughly $327 million ($17 per share) versus a current market cap of $191 million.

(2) Cash Generation: Even without asset sales, the company’s 12% norm. FCF yield and active buybacks support strong compounding potential and capital returns.

Risk - (1) Execution Risk: A limited pool of potential buyers could delay or complicate asset sales, slowing value realization. (2) Margin Pressure: Inflation, cost structure challenges, and physician pushback on efficiency measures could weigh on profitability. (3) Regulatory Risk: Upcoming Medicare reimbursement cuts (~40% revenue exposure) pose a potential earnings headwind, though likely not material.

Introduction

Medical Facilities Corporation (MFC) has been widely discussed over the past years for example by

or Daniel Smoak.I first bought the company at around 9 CAD and sold into the tender offer earlier this year, realizing a gain of ~100%. With the share price now lower, the business performing strongly, management actively buying back stock, and investor attention having faded, I thought I’d briefly reintroduce it here.

Business

Medical Facilities Corporation is a Canadian company that owns a majority stake in three specialty surgical hospitals and one ambulatory surgery center in the U.S. Its facilities focus on high-value orthopedic and neurosurgical procedures, generating revenue from patients and insurers. Demand is resilient, with elective surgeries typically deferred rather than lost in downturns. The payor mix is balanced between Medicaid & Medicare (40%), Private (55%), and other (5%), which is highly attractive relative to the average U.S. hospitals payor mix.

Sioux Falls Specialty Hospital, the largest of the group, performs roughly 45%1 of all surgeries in South Dakota. While Oklahoma Surgical Hospital (OSH) and Arkansas Surgical Hospital (ASH) are less dominant in their respective states, they are still regarded as market leaders. All facilities operate in hyper-localized markets with high barriers to entry, and with only about 250 specialty surgical hospitals across the entire U.S., these are scarce and strategically valuable assets. All three hospitals consistently receive national awards and rank among the top 1–5% of U.S. surgical facilities for quality, patient experience, and outcomes.

Especially in periods of heightened volatility and uncertainty, this appears to be a particularly attractive business to be in.

Note on the Financials:

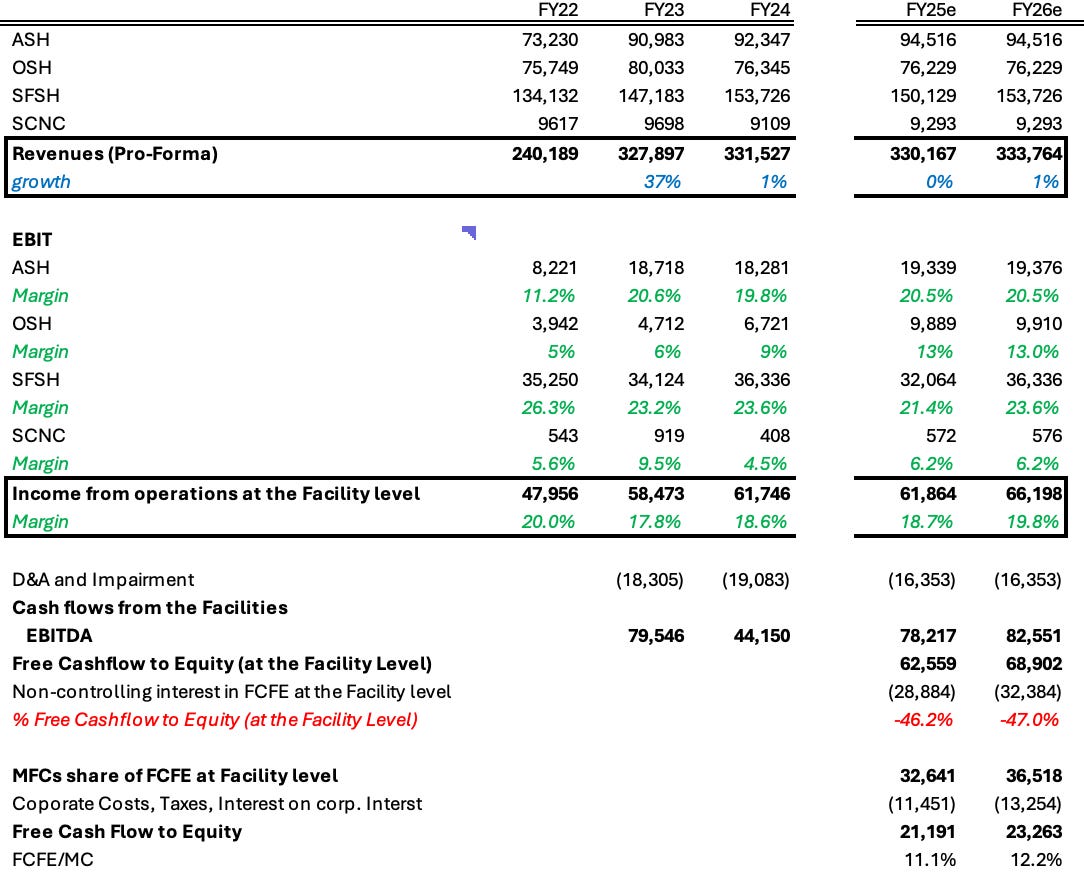

I won’t go into the complex financial and ownership structure, as it has already been explained excellently by Trident Opportunities and nothing has changed since then.

In short: about half of the EBITDA, debt, and a small portion (~20%) of cash belong to minority owners. Medical Facilities holds majority stakes of 51% in ASH, SCSN, and SFSH, and 64% in OSH.

History

Medical Facilities Corporation was once a five-hospital platform focused on premium specialty surgery, complemented by a roll-up of ambulatory surgical centers (ASCs). After a large failed acquisition and underperformance of the ASC segment, major shareholders led by Converium Capital pushed for a strategic overhaul, in 2022. A new CEO and board were appointed, and the company shifted to a focused strategy: halting acquisitions, divesting non-core assets, cutting overhead, and returning capital to shareholders.

Three years later, the turnaround has been a clear success:

Share price increased from ~CAD 8 to ~CAD 15

Divested non-core assets, selling all but one ASC

Began divesting core assets in late-FY24, starting with Black Hills Surgical Hospital (BHSH)

Stabilized margins across the hospital portfolio

Reduced corporate costs from ~$20M to ~$10M

Reduced the share count by ~40% since FY22

Share count growth: FY22 -5.5%; FY23 -14%; FY24 -8.8%; YTD FY25 -18.1%

Activists and large shareholders continue to push for a full divestment and wind-down of the company, as many view the significant corporate overhead (~20% of EBIT att. to MFC) as unjustified given the limited value it provides.

Valuation / SOTP

Base case: Full sale and buybacks

The most widely expected outcome, including by Converium Capital, is that MFC will sell all remaining hospitals. This view is reinforced by the fact that MFC has already sold one of its core facilities, BHSH. The proceeds would primarily be used to repurchase shares. This approach effectively maximizes shareholder value by monetizing high-quality assets at attractive multiples while shrinking the equity base.

To assess the upside from asset sales, two key factors in addition to timing have to be considered:

EBIT growth at the facility level

Valuation multiples

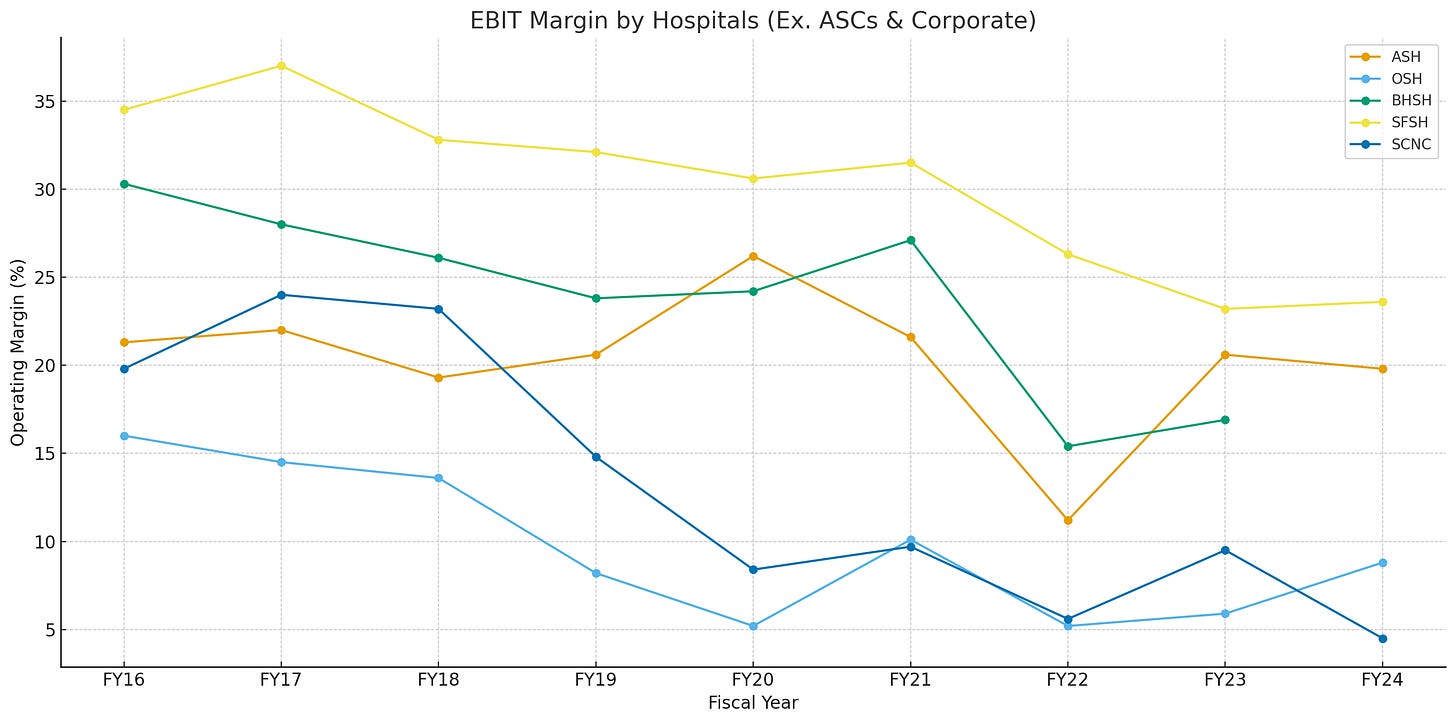

1. EBIT growth at the facility level

Revenue growth is supported by steady 2–4% annual price increases and similar volume growth, driven by demographics, surgeon additions, and service expansions.

While cost inflation remains elevated, pricing power and efficiency gains largely offset the impact on EBIT. Competition levels are elevated, but stable and not a major threat.

A heightened emphasis on hospital-level cost discipline has contributed to margin stabilization and, in certain facilities (OSH & ASH), to a meaningful margin recovery following years of insufficient operational oversight. For my valuation I assumed stable normalized EBIT, although a conservative 3–5% annual growth appears very reasonable.

Note: SFSH is temporarily impacted by margin pressure from a facility move in Q2 FY25 (excluded from normalized EBIT, using FY24 margins).

Hospital (% of EBIT in H1FY25): SFSH (50%), ASH (40% ), OSH (25%), SCNC (1%), Corporate (-16%)

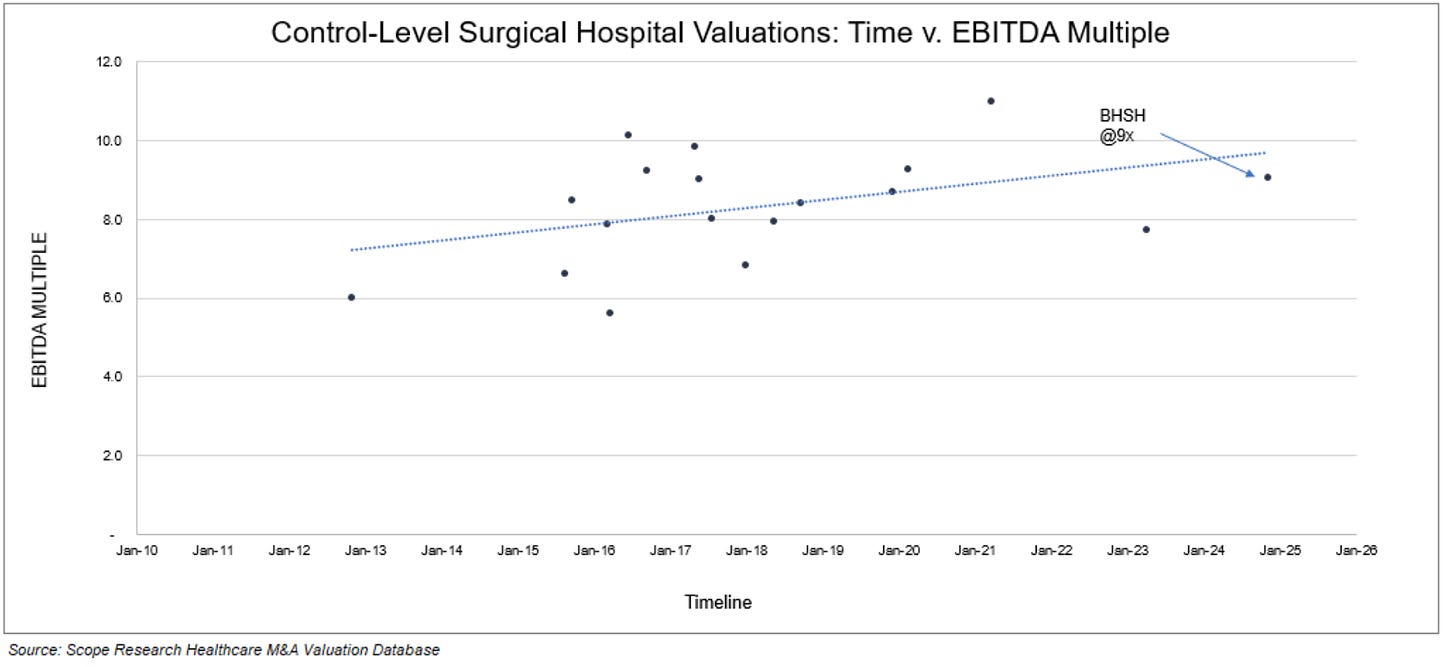

2. Valuation multiples

Ambulatory surgery centers

In the ASC space, Surgical Partners has successfully executed a roll-up strategy, typically paying around 8x EBITDA. These centers, however, tend to be lower-quality assets compared to MFC’s hospitals, given their weaker payor mix and fewer quality recognitions.

BHSH Transaction

Black Hills Surgical Hospital was sold for $194 million, generating $21 million in LTM EBIT (Q3 FY25), implying a ~9x EBIT and ~8x EBITDA multiple. This provides a clear, recent benchmark for high-quality specialty surgical hospitals.

Industry View

Across the sector, 8–10x EBITDA is generally the multiple paid for most transactions. And most experts and investors I’ve spoken to believe ~9-10x EBITDA is realistic for the remaining hospitals, particularly SFSH and ASH, given their quality, orthopedic-heavy revenue mix, and market positions. Some even argue that SFSH may warrant a large premium up to 12x EBITDA.

Upside Case - contract lift

Some strategic buyers or large hospital systems could be willing to pay mid-teens EBITDA multiples by leveraging the target’s favorable payor mix or contracts to improve rates across their broader network. This can meaningfully increase the economic value of the acquired hospital, justifying a premium to standard market multiples.

Conclusion

Assuming an 8–10x EBITDA multiple for the remaining hospitals appears reasonable, reflecting recent transactions, industry benchmarks, and the high quality of MFC assets. Additional upside could materialize if strategic buyers pursue acquisitions or if SFSH secures a premium valuation above 10x EBITDA. Nonetheless, given the limited sample size of comparable transactions, particularly more recent ones, I prefer to apply a more conservative 7.5x EBITDA (~9x EBIT) multiple to incorporate a meaningful margin of safety.

Potential upside over the next three years, based on my assumptions, is approximately 107% (driven by 71% from asset sales and 3x 12% FCF yield). If the 12% normalized FCF yield continues to be deployed into buybacks at ~$10 per share, the upside could increase to around 147%. The strong shareholder support for buybacks, combined with the pace of repurchases, suggests a high likelihood that excess cash will continue to be deployed this way. Further upside will depend on the sequence of divestitures and the share of proceeds allocated to buybacks.

See Appendix – Valuation Model for the complete Excel valuation model

Alternate case: No sale, FCF compounding & re-rating

If buyers do not emerge at fair valuations, MFC could retain its hospitals and continue aggressive buybacks, or pay out a substantial dividend. Given the company’s current ~12% FCF yield, this scenario would still likely generate +12% annual returns, potentially drawing in dividend-focused investors and supporting a multiple re-rating over time.

Risks

Margin Pressures and Recovery Levers

Margins have trended down in recent years due to cost inflation, increased competition, and weak execution. According to management, cost inflation remains by far the biggest driver of this decline. Although absolute facility level EBIT has remained broadly stable, suggesting that inflationary pressures have been largely offset by price and volume increases. Management is doubling down on efficiency initiatives and cost savings, believing there is meaningful upside left in margins. The most significant lever is the rollout of a standardized implant formulary, which could save ~$10 million p.a., though this faces pushback from physicians incentivized by specific suppliers.

Continued focus on cost control and price increases should support stable, if not higher, margins even in a sustained inflationary environment.

Not many Buyers

A further key risk is the limited pool of potential buyers. Even at conservative valuations, acquiring a hospital requires $60–360M, which restricts the field to only a handful of well-capitalized players. Given the highly localized nature of these assets, strategic fit further narrows the list. Realistically, only groups like Tenet Healthcare, Surgery Partners, large hospital operators, or select private equity firms are viable buyers.

Medicaid & Medicare Cuts (total exposure: 40% of revenues)

Exposure to Medicaid, a government-funded insurance program for low-income individuals, is very small. This limited reliance highlights the premium positioning of the company’s facilities. While reimbursement cuts are expected by the end of 2027, the financial impact should be minimal given the low exposure.

A large portion of revenues is tied to Medicare, a government-funded insurance program for seniors and people with disabilities. While reimbursement cuts are planned, they are not expected to materially impact specialty surgical clinics.

Overall, these cuts pose a manageable risk, well below that of the broader hospital industry.

Conclusion

The upside is compelling, with an expected CAGR of roughly 28–35% over three years if the asset sale is completed as anticipated. There’s significant additional optionality, as the multiple underlying my return assumptions is conservative and EBIT growth could further enhance returns. Even in a no-sale scenario, the downside is cushioned by stable FCF and likely 12%+ annual returns through dividends or buybacks, supported by top-tier hospital assets.

Given the quality of the underlying business, limited cyclicality, and a credible activist shareholder base pushing for monetization, downside risk appears minimal while upside remains substantial. This creates an asymmetric risk-reward profile that’s hard to ignore.

Appendix - Valuation Model:

No pro-forma cash flow figures are available at the facility level, making it impossible to calculate historical FCFE for FY22 through FY24.

Black Hills Surgical Hospital and SFSH together account for roughly 75% of all surgical cases in South Dakota, with BHSH generating about $100 M and SFSH $150 M in revenue. Based on this, SFSH’s share is inferred to be approximately 45% of total surgical volumes.

Thanks for the good write up. I have a couple of questions which I was hoping you could help me with:

1. What is the driver of expected volume increases of 2% - 4% and is there capacity (doctors / theatre time) at the hospitals for this higher volume?

2. Regarding Medicare, why do you say that expected cuts aren’t expected to impact speciality surgical hospitals?

3. How do the doctors get their equity share in the hospitals and what happens when doctors retire and a new one comes in? Could these doctors be problematic when it comes to selling the hospitals?

Thanks for your time

Doesn’t much of that FCF go straight to the doctors, not the shareholders or company? Check the high non-controlling interest payments they pay out in their cash flow statement. This is an area I find many people miss with this company.