Today, I am going to write about Comerzzia.

A Solution by Tier1 Technologies SA, my initial Tier1 write up can be viewed here:

As with my report, I wanted to thank

for helping me with some of the research. His opinion and mine don’t necessarily coincide.The aim of this report is not to give you a short overview of Comerzzia, but rather to provide you with as comprehensive a picture as possible. The first chapter will be an outline, so if you’re only interested in a certain topic, feel free to skip the rest.

As always,

I am very grateful for any feedback.

Do your own due diligence. Fact-check anything I say. It’s always possible that I made minor or major mistakes, even though I rigorously try to avoid them.

Disclaimer

This article is for informational and educational purposes only. Do not interpret anything below as financial advice. Always do your research & speak to a financial professional before making investment decisions. Stock prices and market value have changed since the time of writing. This is NOT a buy or sell recommendation.

Additionally, do consider that this is my largest position by far. Therefore, please assume that I am highly biased, even though, as with making mistakes, I rigorously try to avoid it.

Outline

Basics

Comerzzia is Tier1’s unified point of sale (POS) solution and the main driver of the investment thesis

Based on my estimates Comerzzia’s net income margins on incremental revenues are around 30-50%1

Comerzzia contributed to more than half of Tier1’s software segment revenue (€9.7m in FY23) and around half of its profits.

Approximately 50% of Comerzzia’s revenues are recurring, coming from licenses.

While exact revenue figures by country are not available, we can assume that nearly all revenues are generated in Spain

When I mention Gartner as a source, I am referring to their report, "Market Guide for Unified Commerce Platforms Anchored by POS for Tier 2 Retailers."

Gartner is a highly respected global research company specializing in the IT sector

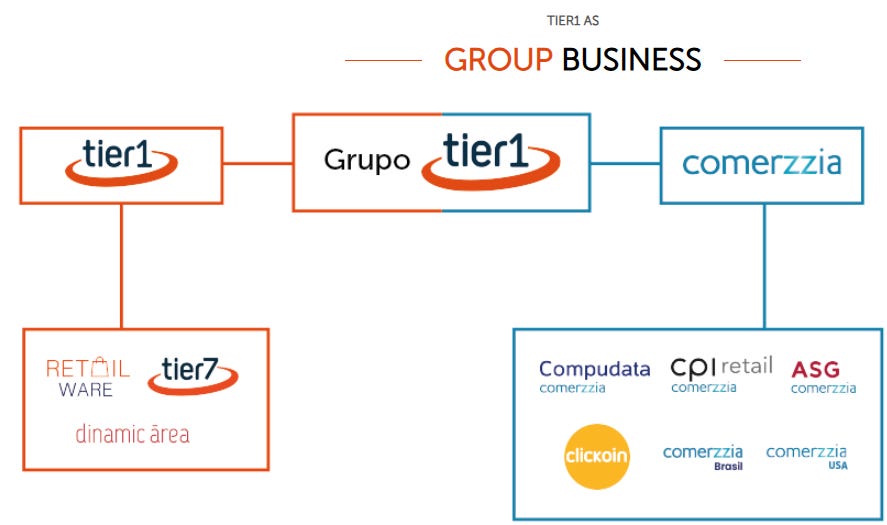

(Nexxt, the most recent M&A is missing, but is a holding of the Comerzzia Hold-Co)

General & History

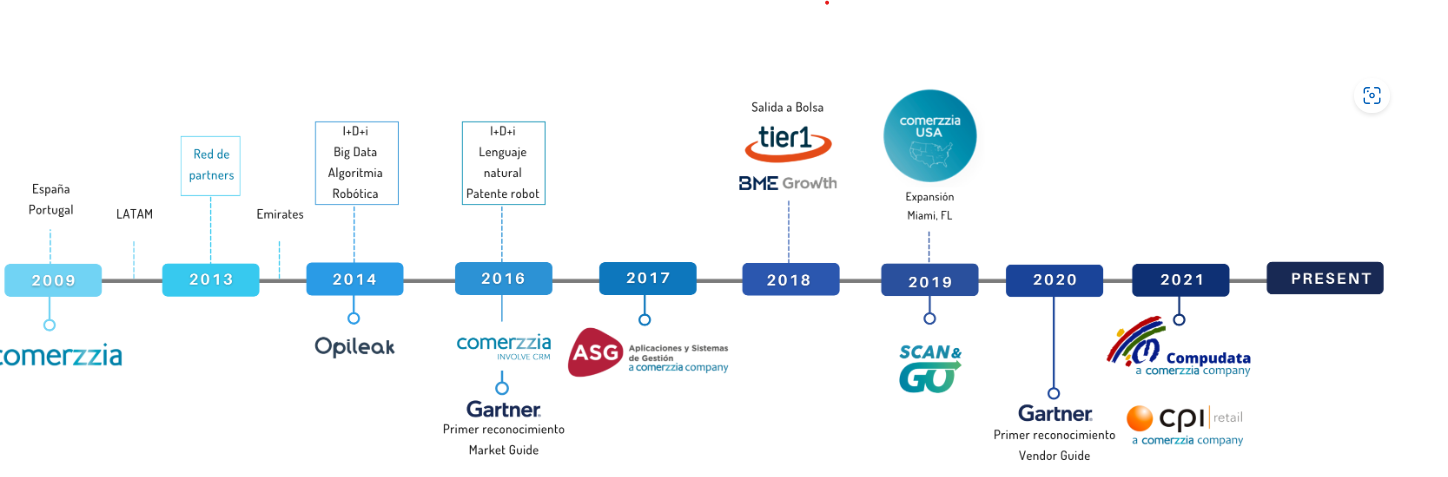

The initial omnichannel solution created by Tier1 was based on Attractor (Tier1’s ERP solution). However, after consulting with Gartner and recognising the significant potential in the omnichannel / unified retail POS market, they began developing a standalone solution called Comerzzia in 2009.

Being early to this market and developing a solution from scratch might have given Comerzzia some competitive advantages that continue to benefit them today.

Since FY16, Comerzzia has been recognized by Gartner in its "Market Guide for POS" as one of the most relevant platforms worldwide for the management of store chains.

Today it’s most prominent attributes and differentiating factors are

Flexibility: extreme personalization capability

Supported by giving clients access to the source code

Compatibility: Comerzzia can be used on all prominent cloud providers and also can be plugged into most solutions (ERP, …)

This high degree of compatibility and flexibility is something echoed by customers

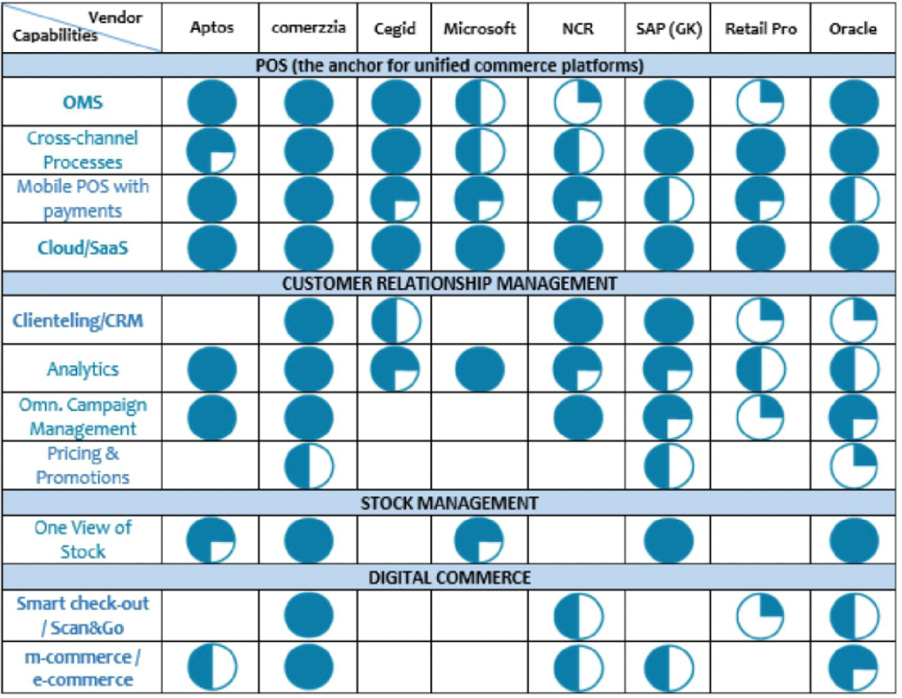

Breadth of offering:

Comerzzia has one the largest breadth and depth of offering on the market. This is a comparison of Comerzzia and solutions focused on very large retailers:

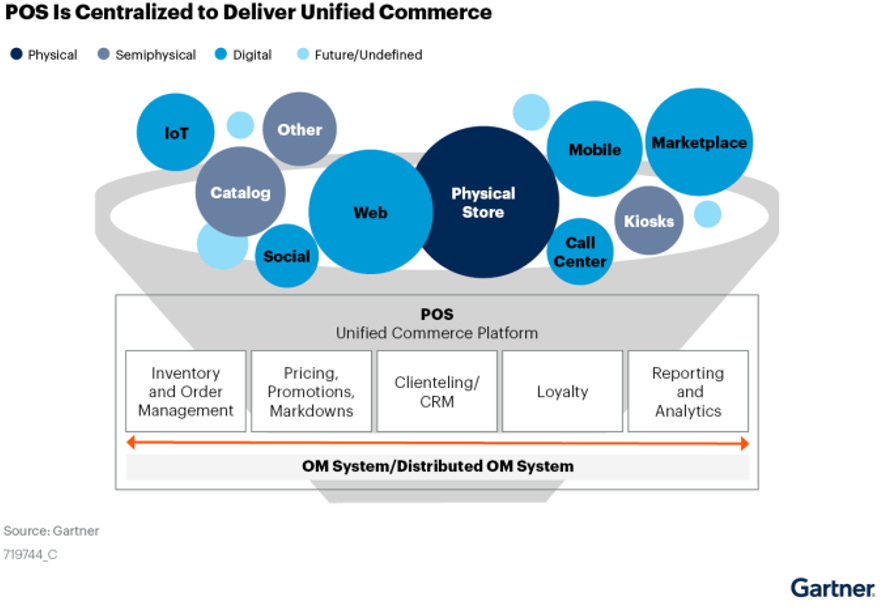

(Source: "Unified Commerce Platforms Anchored by POS for Tier 1 and Tier 2 Retailers" - by Gartner.), the circles indicates the depth of offerings

The Sector - Unified Retail Commerce

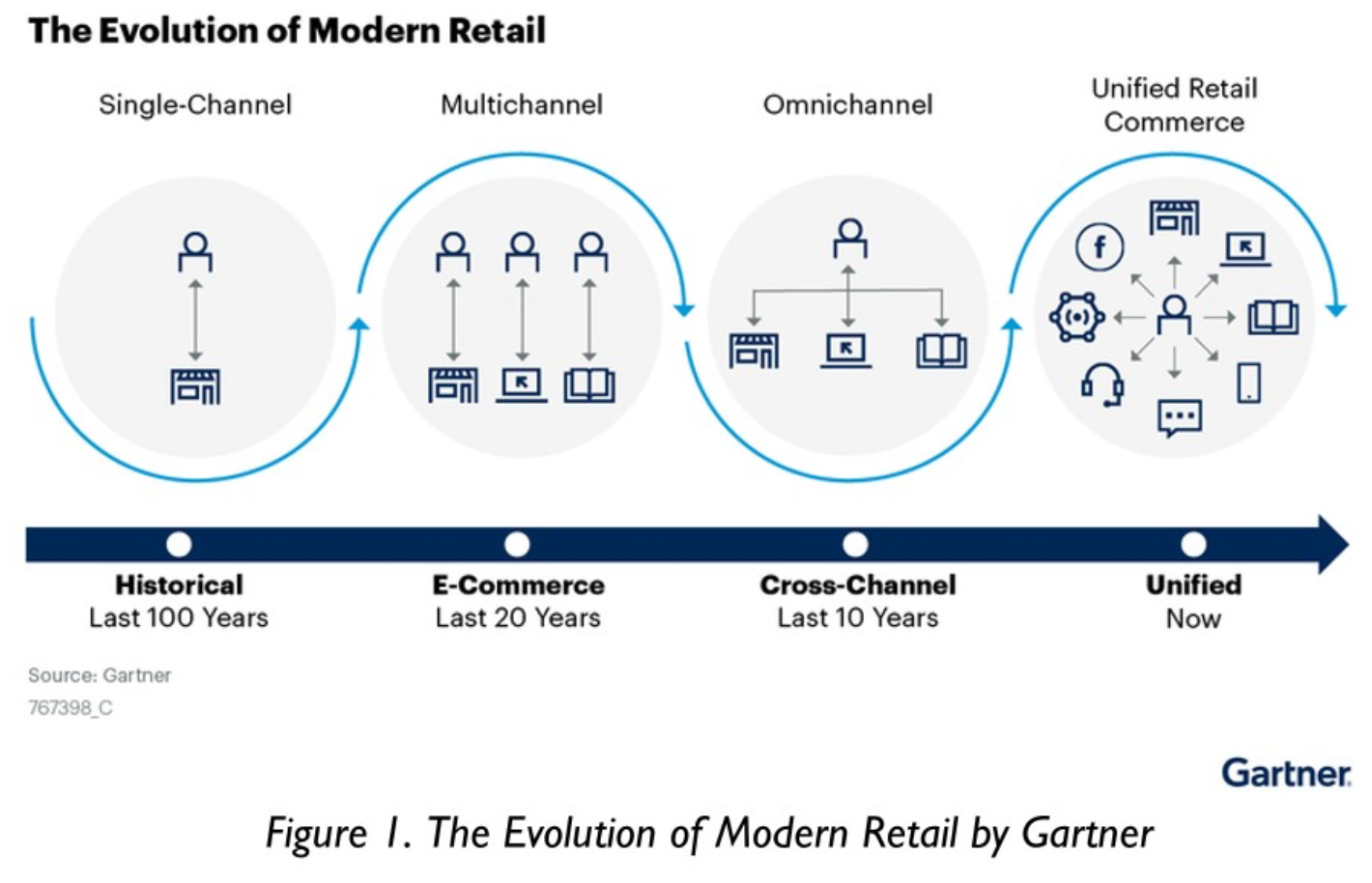

Unified POS solutions provide multiple points of sale across both the digital and physical worlds. Their core focus is to seamlessly connect these two realms, enhancing the customer experience and streamlining operations

Examples:

Self-checkout POS, in-store scanning of products and paying automatically (Scan & Go), online ordering and picking it up in-store (click & collect), …

These access points require unified inventory management, order management, and other integrated solutions to function effectively. Additionally, they collect vast amounts of data that can be analyzed. Both factors introduce a significant degree of complexity to the system.

The current state of the market according to Gartner

Multiple disruptions in the past years

COVID, Supply chains, high inflation, …

Near or real-time insights are increasing in importance

Primary POS is still the physical store, c.70% of all retail sale

A growing need for seamless cross-channel POS

The consumer wants to buy when- & wherever he wants)

Online Sales are increasingly supported by physical stores (think click & collect)

The need for true unified solution, is growing rapidly

Growth drivers

Most sources project a 8-12% yearly market growth for the unified retail commerce platform market, as well as a similar CAGR for the POS software market

The market growth is attributed to2

Increasing customer expectations

Retailer’s need for unified solutions (spanning their operations)

The need for agile, cloud-native, saleable and modular solutions

Ability to simplify data mobilization (e.g. Loyalty apps and analytics)

Expanding offering

The customers perspective

“Customers want to be able to search, transact, acquire, and consume products and services across a retailer’s entire ecosystem in a seamless manner” - Gartner

Retailers face significant risk of lagging behind competitors and loosing customers

Currently, it's likely that the majority still rely on outdated legacy systems.

Retailers' Product Expectations & Needs

Clienteling and loyalty

Customer profiles (order history, loyalty...)

The gathering and analyzing of real-time data

Inventory management solutions (IM or IMS)

Growing demand due to increased supply chain automation, like micro-fulfillment centers and click & collect services

Approximately 30%3 of online orders are returned, often directly to stores adding to the layers of complexity

A unified POS solution such as Comerzzia can offer these IMS, with minimal friction

Order management software (OMS or OM)

Increasing complexity and importance, stemming from the necessity of processing orders across multiple channels

Pricing and promotions

Higher demand for unified pricing and promotions across platforms driven by customer expectations

Increasing touch points with consumers

To meet customers everywhere and anywhere

For example through social channels

Functional Capabilities

Mobility of customers and associates

Higher control over user experience

There has been a recent focus of associate-facing user interfaces for Tier2 (500-3000m EUR revenues) retailers, according to Gartner

Decupling front-end from back-end solutions

Being able to plug the solution into all ERPs and other existing software infrastructure to offer the consumer a consistent experience.

Development toolkits

Higher need for adaptability, due to high competition and rate of change

"Retailers are now looking to POS solutions that are modular, flexible and can deliver capabilities that can be implemented within a flexible enterprise architecture that enables agility for resilience" - Gartner

Nonfunctional Capabilities

Collaboration

Between retailers & solution providers and between multiple solutions : to stay at the forefront of innovation

For Comerzzia this is quite interesting due to seemingly being one of the most innovative solutions out there. An indication for this is their product breadth

Support and Services

Customers must be confident in strong and global support

Comerzzia provides global support mainly through its large partner network, outside of Spain.

Tier1 vs Tier2 retailers

Tier2 retailers generally exhibit higher agility and innovativeness compared to Tier1 retailers. They are typically quicker to adopt modern POS development approaches such as native cloud, composable, and headless architecture.

Risk of increasing churn due to easier switching

It might be detrimental to the overall industry if competitors increase the level of integrability into existing systems

Flexibility or ease of integration, goes hand-in-hand with easier plugging-in of new solutions and therefore easier plugging-out of existing ones

Possible effect: The churn and competition on price might increase

Some counter points:

A significant consideration is that implementation costs must decrease substantially for this scenario to occur.

Currently, around 50% of Comerzzia's revenues are recurring, indicating that implementation costs are likely equivalent to approximately 1-2 years worth of SaaS subscription.

Moreover, ease of implementation is just one aspect of the overall calculation.

For instance, training in-house IT staff to adapt and customise the new solution can lead to a loss of human capital when transitioning between products.

Additionally, the business would need to adjust to a new solution in various small ways. A switch could result in further human capital loss and additional costs associated with adapting to the new system.

There are many other components that contribute to switching costs, leading me to conclude that this is probably not a substantial risk, but it is something that should be monitored closely.

Gartner touched on this on Pg11 of the "Market Guide for Unified Commerce Platforms Anchored by POS for Tier 2 Retailers"

Comerzzia - The Product

Each module includes multiple sub-modules

Evaluations and testimonials consistently highlight:

Adaptability

Flexibility

Ease of use

Comprehensiveness

Standard integrations available for most ERP solutions

Features a very open architecture

Advertised as having the lowest cost of ownership

Available as either SaaS or On-Site version

Comerzzia offers the following Modules:

1. Comerzzia Enterprise Suite POS

Starting at 89 EUR/month per POS

Includes POS and other essentials

Sub-Modules: POS, FastPOS, Scan&Go, Self Check-out, WHO (inventory), etc.

2. Comerzzia Enterprise Suite Involve CRM Loyalty

Starting at 250EUR/month

Loyalty and marketing solution

Measures the impact of campaigns and promotions in an online store and a loyalty app (developed by Comerzzia)

3. Comerzzia Online Store

Starting at 500 EUR/month

Functions as another store with unified prices, promotions, and customers

Provides complete visibility of inventory to ensure consistent experiences across channels (offline & online)

4. Comerzzia Involve CRM Analytics

Starting at 2600 EUR/month

Advanced analytics module

Provides in-depth customer knowledge

Allows for personalized sales and communication strategies

5. Comerzzia Services

Starting at 2000 EUR

Consulting for retail marketplaces and more general services

Other Solutions & Cross- and Upselling

Comerzzia’s subsidiaries also offer multiple other more specialized solutions. I will highlight these in the subsidiary part of the report.

Some of the growth naturally stems from up- and cross-selling within the Comerzzia hold-Co, as well as from non-Comerzzia solutions and clients from the IT-Services side of the business.

Future role of AI

José Luis Cordero Amarillo (COO of Comerzzia), talked in a LinkedIn post about how Comerzzia harnesses the power of AI and will in the future harness it evermore for loyalty related services

I believe this is a genuine use case and not just hopping on a trend.

Comerzzia often times works with huge amounts of real-time data. AI will help in sorting, analyzing, and responding to data effectively

Indicators for product quality and competitive advantages

I'm not sufficiently familiar with the software or retail side behind Comerzzia to assess whether Comerzzia has significant competitive or quality advantages compared to its competitors. However, several points strongly indicate advantages and quality at Comerzzia and were sufficient to convince me.

1. Growth and high incremental margin

According to management, Comerzzia often competes directly with much larger solutions, including nearly all of those highlighted by Gartner.

High incremental margins, combined with growth, demonstrate that Comerzzia does not rely on cutting prices to gain market share. Coupled with the fact that they primarily compete against larger solutions, this might indicate quality or competitive advantage.

2. Large customers and partners

The significance of the size of partners and customers lies in their lack of constraints due to size. They have the option to choose other similar but more established solutions, such as those offered by GK Software.

Customers:

Switching costs for customers are high, so for a very large retailer to implement some lesser known solution (comerzzia) is quite the risk and might indicate product quality or competitive advantages.

Large partners

Must allocate resources, such as requiring multiple employees to undergo extensive training.

Business risk: if the solution does not meet clients' expectations, it directly impacts the partner's reputation.

Additionally, 2 new Gold partners had their respective head of retail, comment on the partnership, which seems quite astonishing when comparing the size of Comerzzia (c.5m revenues) with the size of Inetum (c.2,5Bln in FY23 globally) and Retex (c.100m revenues in FY22)

In the following 2 chapters I will write more in depth about the Partners and Clients

Customers

General

Comerzzia, on the one hand, has a few very large food-retail customers (none are directly mentioned due to contractual constraints) of a similar size to Tesco in England, Walmart in the US, or Rewe in Germany, but most of their clients are mid-sized retailers (€500m - €3Bln in revenues), so-called Tier 2 retailers.

The majority of revenues and customers are in Spain.

Larger clients typically utilise Comerzzia solutions solely in Spain or other specific locations, rather than across their international retail presence.

Customer concentration: very low, probably low single digits %

Churn rate: no exact number, but probably very low

Sector focus: All kinds of retailers, from fashion to wholesale to food retailers.

Most clients use multiple of Comerzzia's solutions from the get go

SAP

Many clients utilise an SAP-based ERP system, attributed to Seidor's significant role as the largest SAP reseller in the EU. Seidor is Comerzzia’s most important and longest-standing partner, a topic that will be explored further in the “Partners” chapter.

A quote from a direct message on twitter

"(…) they are happy with Comerzzia. The tool is powerful and gives them the freedom to personalize, which is absolutely key from them. Also explained to me that some people of the retailer IT team did a Comerzzia "master" to deeply understand the software and be able to personalise it" - (@Source thanks again for reaching out to me)

Gartner

When comparing Comerzzia’s attributes in the Gartner studies with those of competitors the breadth of offerings, adaptability and other talked about characteristics become quite clear.

Competition

Comerzzia mostly gets pitched vs larger competitors, so growing profitably even though they are facing the strongest solutions in Europe says a lot

GK Software is the main competitor (confirmed by management)

GK Software is not only offered as a standalone solution but is also sold as SAP's white-label POS solution. Consequently, it is often implemented alongside SAP ERP, much like Comerzzia.

GK Software generates approximately 25 times the revenue of Comerzzia and is the leading installer of retail software in Europe according to Gartner.

The market is highly fragmented with numerous different solutions available.

For Tier1 and Tier2 retailers (revenues > 500mEUR), there are 26 Solutions ranked by Gartner, and probably a multitude more not as important and therefore not covered by them. Additionally there are also many more solutions focused on Tier3 retailers.

Comerzzia is a solution implemented by Tier3 to Tier1 retailers, with a focus on the Tier2 & Tier1 market

opinion on GK Software and the competitive situation:

“But it certainly can't hurt to take a look at the competition. Gartner lists 26 solutions from 20 companies in the relevant category "Unified Commerce Platforms Anchored by POS for Tier 1 and Tier 2 Retailers". These companies are: Sitoo, Oracle, PCMS, Diebold Nixdorf, NCR, Retail Pro International, Aptos, BayBridgeDigital, Cegid, Fujitsu, GK Software, Lavu, Manhattan Associates, NaviPartner, NEC, Orisha | Openbravo, Salesforce, SAP, Toshiba and comerzzia. SAP and GK Software are double counted, as the SAP solution is a product of GK Software (but they offer the solution also independently). GK Software was also acquired by Fujitsu (but is still listed on the Hamburg stock exchange).”

…

“So it's (the GK Software retail solution) probably not only the main competitor they see in the market right now, but also one of the strongest overall. GK Software's solution is also the one with the most features, as the chart above shows. (see “General & History” chapter of this write up for the chart) As a generalist, I am certainly not an expert in retail software, but 2-3 years ago I was very interested in GK Software, did some research and even talked to the management. So naturally I compared the two solutions, even before I found the above slide, and also came to the conclusion that comerzzia has an advantage when it comes to what is categorised above as "digital commerce". As far as I know, you can't manage a full e-commerce offering with GK's software, nor is there a solution for in-store scanning via smartphone. Overall, I think the description of GK Software's features matches my own impression of their capabilities, which gives me hope that they've done a good job with the other competitors as well.”

Partners

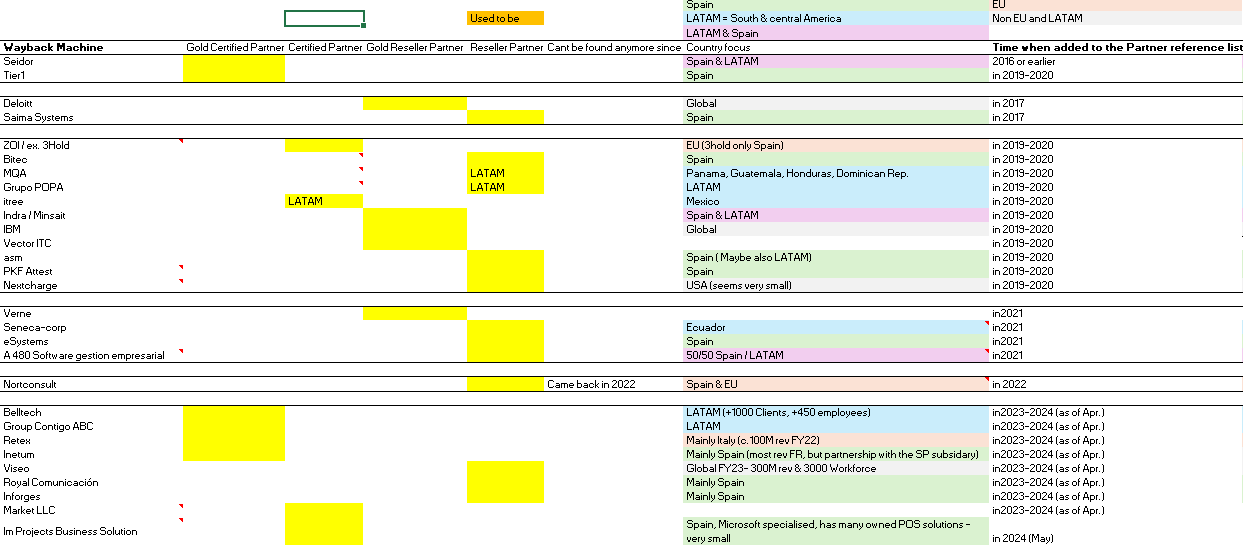

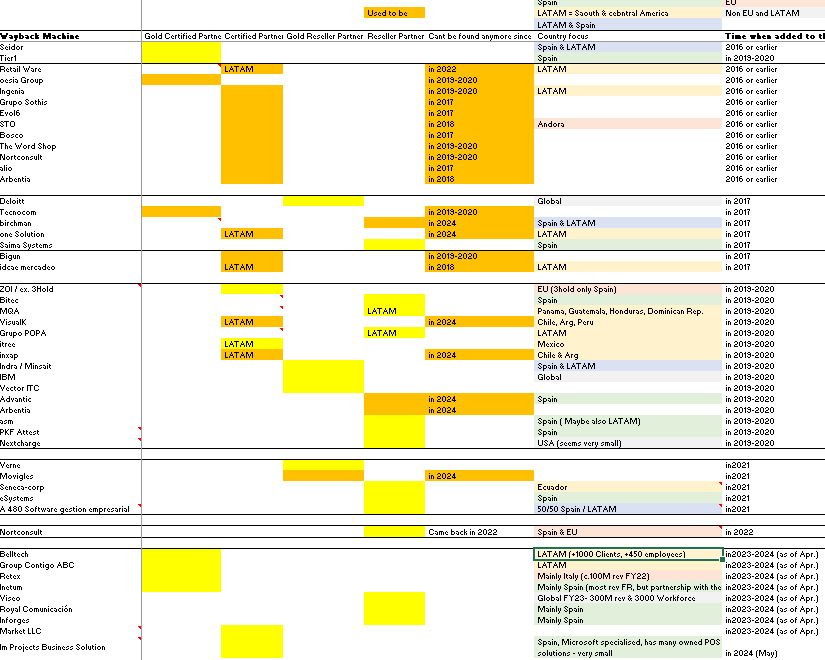

For this list, I reviewed screenshots of the Partner-reference list on older versions of the website using the Wayback Machine. (Refer to the Appendix for the complete history of Comerzzia Partners since 2016)

General

Comerzzia began forming partnerships in 2013, 4 years after its founding

Most partners offered a single unified / omnichannel POS solution, though a few also provide their clients competing products.

Partner Dynamics:

There was a significant increase in partners during FY16 and FY17, followed by many partners leaving until about a year ago.

This could be due to low revenue generation from these partners or a strategic shift from quantity to quality. (pure speculation on my side)

Recurring license revenues

Recurring license revenues are likely to increase in the future as new partners take over implementation, which is currently often handled internally (by Tier 1 Technologies)

Certified Partners

Partners are provided with certification, courses and additional Information.

Most partners travel to Sevilla for in-person training.

Certified partners receive better terms and are categorised based on their training and certification levels.

Certified Partners: Have completed specific training and received certification. They usually handle the implementation of the solutions.

Gold Certified Partners: Have access to the source code in addition to their certification. They collaborate more closely with Comerzzia than non-Gold partners.

Reseller Partners: Primarily focus on reselling Comerzzia's products, as the name suggests.

The main benefits for these partners include better terms and some training

Size of Partners

As we can see, in FY20 they added quite a lot of Partners, none of which gave interviews or comments on the partnership.

Then they didn’t see any large Partner growth for 2 years up until mid-FY23.

From early-FY24 to the present (Mid-FY24), Comerzzia began partnering with many very large companies. Notably, Retex and Inetum. These stand out as they provided short statements about the partnership, despite Comerzzia being a relatively small solution. Additionally, Inetum participated with Comerzzia in a the largest retail forum in Spain, indicating that these collaborations are more in-depth than previous ones.

I assume that we should see some top line growth from these partner ships in H2 FY24 onwards

Mini Timeline of Gold Partners in FY24:

Retex Jan 24

Group Contigo ABC Feb 24

Inetum Apr 24

Belltech May 24

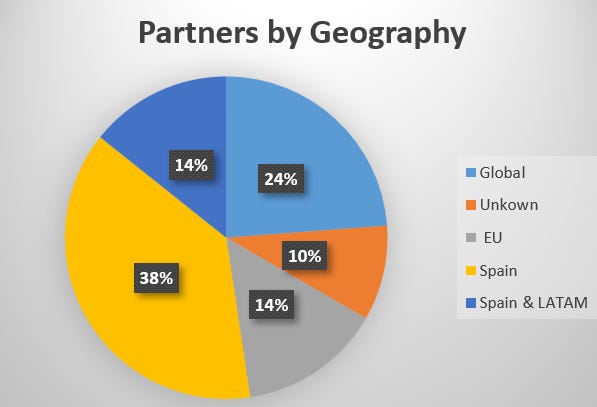

Geographic focus of Partners

(21 in total)

The most important Partners

Tier1

The Parent Company of Comerzzia

Owns 90% of Comerzzia

Does a large part of the implementation

Partially indicated by the stark contrast between consolidated and unconsolidated net income, as well as by statements from the management

Seidor

Partnership since very early on

Owns 10% of Comerzzia

Comerzzia is quite prominent on the retail sector page of Seidor’s Website

+9000 Employees

est. 1Bln Revenues in FY23

Active Worldwide, but with a focus on Spain and LATAM

Retex

Partnership since Jan. 2024

100m revenues in FY22

Marketing and IT-Consulting for unified / omnichannel solutions

Based in Italy and has some minor operations in China

Large clients

Lavazza, Barilla, Aperol 1919, Carrefour…

Statement by Retex & Comerzzia

"Joining as a gold certified partner of comerzzia is a step forward in our mission to redefine the meaning of retail. We are excited by the opportunities that this alliance gives us, the opportunity to further promote omnichannel in retail." - Luca Venturoli, Managing Partner - Consumer Retail & Food Service at Retex

“Javier Rubio, CEO and Founder of comerzzia, has highlighted the importance of this incorporation of Retex to the network of partners: "The incorporation of Retex as our partner in Italy not only reinforces our presence in Europe, but also opens doors to international markets such as China. We are convinced that this collaboration will allow us to offer unified commerce solutions that significantly improve the consumer experience in Italy."“

Group Contiguo ABC

Partnership since Feb. 2024

Based in Mexico

Low online presence, so very hard to est. the size

Inetum

Partnership since Apr. 2024

The total company generated approximately 2.5 billion EUR in revenues and operates internationally, with France being the largest revenue contributor, followed by Spain.

The partnership is with the Spanish subsidiary, which generated about 400 million EUR in revenues in FY23.

Expanding the partnership to the rest of Inetum seems likely and has been suggested by management.

The partnership appears to be very close, as indicated by management statements and their joint presence at the "Retail Forum Madrid 2024"

Statement by Inetum & Comerzzia

"At Inetum we are committed to offering our clients cutting-edge solutions that drive their success in an increasingly competitive market. We are confident that our partnership with comerzzia will allow us to offer even more value and innovation to our clients," said Francisco Argos. , director of Retail & Consumer Goods at Inetum.

"The incorporation of a partner like Inetum, with extensive experience and recognized capabilities in implementing software projects in the retail sector, enriches the COMERZZIA partner ecosystem and offers our clients a new trusted leading partner. We are convinced that This alliance will promote joint growth and will allow retail companies to continue successfully transforming," said Sergio Lafuente Porres, CEO of comerzzia.

Belltech

Partnership since May. 2024

Based in LATAM

+450 employees

+1000 customers

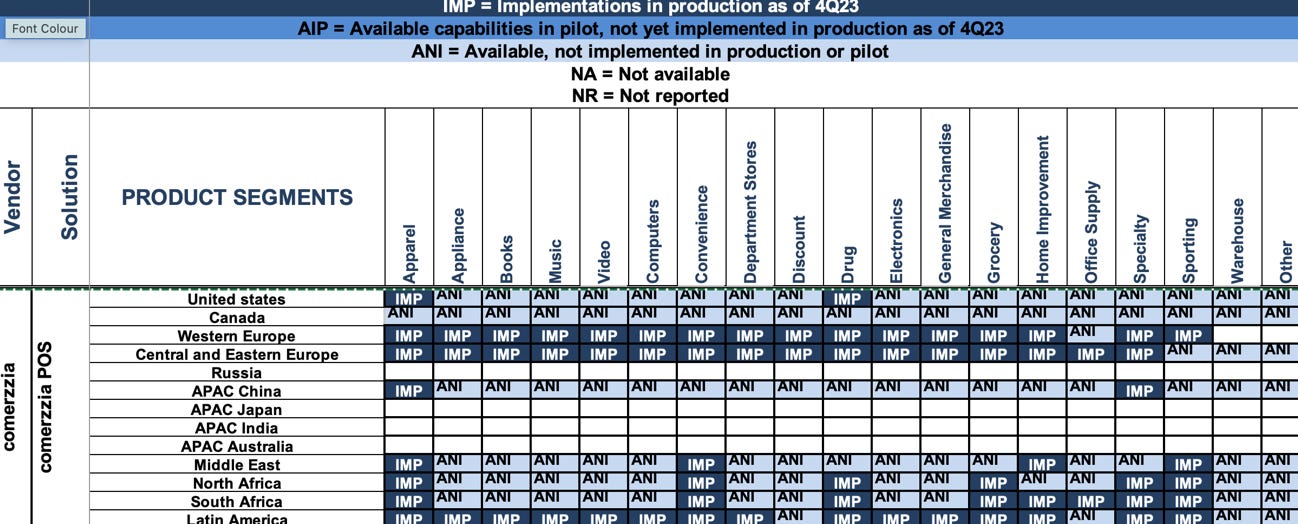

Implementations by region

(Source: Gartner)

Here, we observe implementations categorized by sector and geography, highlighting a clear focus on LATAM and EU regions.

It's noteworthy to acknowledge the global reach evident in these implementations.

Subsidiaries

All of them sell Comerzzia to clients but also offer their own specialised products.

Typically, existing management stays in charge and retains the remaining shares.

For the past three acquisitions, they paid between 0.3x and 0.8x Sales (P/S).

Nextt

Acquired in late 2023; Comerzzia owns 52%.

Offer:

Software for restaurants: POS-Software, kitchen software, back office modules, e-commerce & delivery module, business analytics …

Financials

Since FY21 they have had quite stable revenues of 1,6-1,8m

Profitability seems to have declined in FY23, c.100K EBITDA in FY22 to -7K

Their revenues aren’t currently consolidated, but will be in the future

Growth should start picking up again once the cross selling starts

Customers

Most revenues generated in Spain

e.g. Pizza Hut Spain

Why Buy

Increasing product breadth

Restaurant software

Cross Selling

Many of the other clients have some kind of restaurant at their stores

Customers & Brand

Some large & well known clients

Compudata

Acquired in 2021; Comerzzia owns 62%.

Founded in 1983

Offer:

Unified / Omnichannel POS solutions (some of which from Comerzzia)

Solutions specialised for Wholesale & Warehouses

Customers

Most revenues generated in Spain & to a smaller extent in Portugal

Financials

Around 2m revenues (in FY22)

c.50% Software driven & 50% It-Infrastructure / It-Services

Net Income: 242K (FY23, unconsolidated)

“Compudata has undergone an important transformation process, turning a company that sold and repaired computers into a company that implements software to top-level companies in the food retail sector” - Source

Why Buy

Increasing product breadth

Specialized POS solutions for the Wholesale & Warehouse sector

Cross Selling

CPI – Processos Critativos, Sistemas de Infomacao

Acquired in 2021; Comerzzia owns 51%.

Offering

A unified POS solution for the Fashion and Cinema sectors

Customers

Most revenues generated in: Portugal

Some larger clients in fashion/luxury such as Sephora, Timberland, Burberry…

Financials

Around 700K revenues (unconsolidated, in FY22)

Net Income: 37K (FY23, unconsolidated)

Why Buy

Geographic Expansion:

Active in Portugal.

Advantageous for expansion into Brazil due to a reduced language barrier.

Increasing Product Breadth:

Customers & Brand:

Attracts multiple large and well-known clients, indicating some reputation

ASG (aplicationes y sistemas de gestion)

Acquired in 2017; Comerzzia owns 100%.

Founded in 1993

Offering

Provides software solutions tailored to the food distribution sector, under the Gemma brand

Offers solutions ranging from those designed for food distributors to those catering to wholesale operations.

Includes a range of services such as ERP, unified POS, and more.

Customers

Most revenues generated in Spain & LATAM

e.g. Cash Depot or GM Food

Financials

Net Income: 157K (FY23, unconsolidated)

Why Buy

Increasing product breadth (Gemma)

Cross selling

Comerzzia Brazil (Joint Venture)

Founded in FY22, Comerzzia holds a 50% stake.

The other 50% is owned by Seidor.

“In the words of Sergio Lafuente Porres, Director of Expansion of Comerzzia in Latin America, "we are convinced that with Comerzzia Brazil we will have a significant success, not only because of the enormous possibilities offered by the country, but also because we enter hand in hand with a local partner (Seidor) of recognized prestige and with great expertise and positioning in Brazilian retail. which already has certified resources in Comerzzia and which is already having a great reception in the market" - Source

The LATAM opportunity

Higher Demand for more solutions:

Tier 2 retailers, particularly in emerging markets, lack the extensive legacy infrastructures that larger retailers in developed markets have. This allows them to adopt newer technologies, such as cloud-native or headless solutions, which are available to them at competitive prices.

Recent Developments

In LATAM, particularly in Mexico, Comerzzia is now frequently among the final contenders in procurement processes, whereas they were previously not even invited.

Currently the LATAM market as a whole doesn’t contribute strongly to Comerzzia’s revenues, probably 5-10% (speculation on my side)

Comerzzia USA

Founded in 2022, Comerzzia holds 100% ownership.

As far as I can tell, they have only had one implementation or sale.

The Future

M&A Strategy

They are satisfied with their current tech stack and intend to focus on acquiring firms to boost sales of their software solutions. This could include smaller partners in strategic locations or IT consulting firms.

International Growth

In FY24, Comerzzia began dedicating a specific person to international sales; previously, this was handled as a secondary responsibility.

As of now the better position in procurements hasn’t translated into substantial contracts, but if the current developments continue the revenues from this market should increase

Partner growth

I would be surprised if the strong partner growth won't continue

And if the existing partners acquired in H1 FY24 (especially Retex and Inetum) won’t attribute to strong growth momentum in H2 FY24

Customer growth

We are currently seeing a continuous increase in customers and also closer collaborations with larger clients such as Eroski, indicated by a LinkedIn post

I believe that there is a lot of potential to grow with existing clients (cross-selling / more volume), especially the very large ones

Additionally, Partnership growth should also be very beneficial

Upcoming PR and other important dates

In the coming weeks, Tier1 will release its preliminary H1 figures, followed by the H1FY23 report likely in mid to late July. Additionally, the plan for the next 3+2 years will be published soon. This will offer much clearer insights into their expansion strategy, anticipated growth in partnerships, and other significant aspects.

The (first) sell side report on Tier1 Technologies, should be published this month (June)

Appendix

Based on looking at the individual companies reports from the Spanish and Portuguese company register

Gartner

Gartner

Great job once again, Isaac. Tx for sharing.

In one of the youtube presentations TR1 showed a lot of clients across several different retail categories. I included it in the post below.

https://jaminvest.substack.com/p/news-and-insights-11